Bank Negara Forex Scandal

Illegal foreign exchange trading scheme refers to the buying or selling of foreign currency by an individual or company in malaysia with any person who is not a licensed onshore bank or any person who has not obtained the approval of bank negara malaysia under the financial services act 2013 or islamic financial services act 2013.

Bank negara forex scandal. And what about the 1mdb scandal. Illegal foreign exchange trading scheme. Bank negara forex scandal. Orders came from the top.

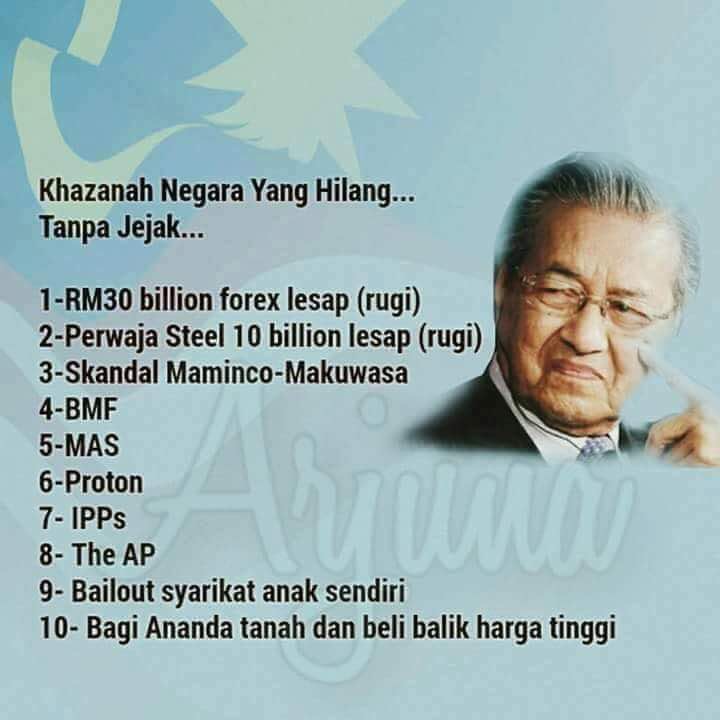

Exclusive a former bank negara deputy manager reveals the inside story the loss of about rm30 billion through forex speculation in the 1990s. Police reports were also made against 1mdb. Bank negara governor muhammad ibrahim said the forex scandal happened a long time ago and that even he was only a student at that time. The year was 1994 when lim kit siang found it ultra important to publish a book on the bank negara malaysia bnm foreign exchange scandal that caused the loss of rm30 billion estimated to be at rm49 billion in today s terms.

He said this in reference to the heavy losses incurred by. Former second finance minister claims responsibility for hedging mistake made in 1990s malaysia. Well unlike the bnm forex scandal the 1mdb case was investigated by the parliament s public accounts committee the royal malaysian police bank negara malaysia and the malaysian anti corruption commission. When government becomes speculator 2 30 ptg sabtu 2 jun 2012 di dewan sri pinang padang kota lama pulau pinang.

Born in kampong kundur rembau negeri sembilan in 1952. Despite mounting pressure from civil society groups and opposition parties demanding accountability the government responded by dismissing the scandal as mere paper losses that came from profits made in forex dealings. Malaysia s former second finance minister tan sri nor mohamed yakcop who served as adviser to bank negara malaysia bnm from 1998 to 2000 admitted to having made the mistake of hedging 100 against currencies. In 1993 veteran dap leader lim kit siang was the first to raise the matter in parliament alleging then that bnm s forex losses was an estimated rm30 billion.

But not a single sen had gone missing. Bank negara forex scandal. In 1992 bank negara the central bank of malaysia engaged in aggressive currency trading eventually running up losses amounting to rm30 billion in forex speculation. Dr rosli yaakob panel jemputan siapa dr rosli yaakob.