Uob Personal Loan Malaysia

Uob personal loan malaysia.

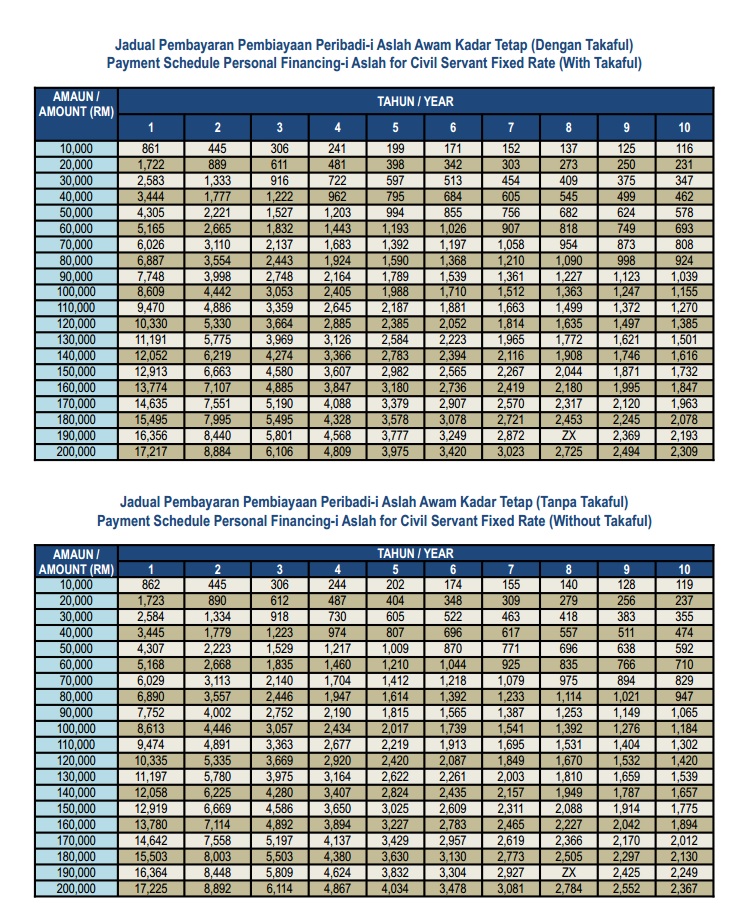

Uob personal loan malaysia. The interest chargeable on this personal loan is calculated on a flat and fixed rate basis and varies according to your income see below. The personal loan from uob is a great unsecured loan that caters for the needs of employee working for the government private sector organizations or self employed workers. United overseas bank berhad uob gives focus on investment banking and financial service either for an investment of a new home pursuing studies and home renovation. United overseas bank uob personal loan.

I we hereby confirm that i we have received read. United overseas bank malaysia or uob malaysia is a subsidiary of united overseas bank limited and was incorporated in 1993 with an aim to be a leader in consumer and commercial banking services in the region. For uob personal loan s approved before 27 january 2018. Transfer funds from your uob savings and or current account to accounts in a participating bank.

The personal loan from uob is a great unsecured loan that caters for the needs of employee working for the government private sector organizations or self employed workers. Instant cash for immediate needs. Full name as per ic passport nric passport number mobile number email address age annual income are you currently employed or running a business required fields. Instant convenient and timely.

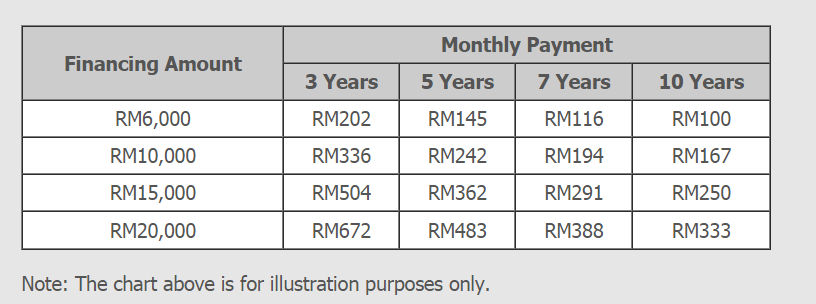

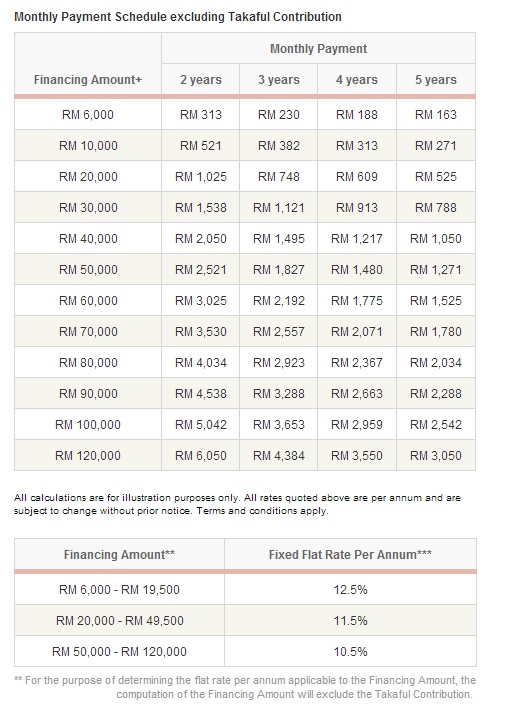

Uob personal loan comes with low interest rates flexible tenures and loan amounts up to rm100 000. Uob personal loan offers financing amount starting from rm5 000 to a maximum of rm100 000 with a repayment period between 1 to 5 years. Eir 7 21 with s 500 cashback. United overseas bank berhad uob gives focus on investment banking and financial service either for an investment of a new home pursuing studies and home renovation.

View and confirm your beneficiary s account number and name before executing the transactions. Uob personal loan is an unsecured personal loan up to 5 years for government servants employees of private sector organizations and self employed individuals and it is mainly focused for those who prefer to apply with a minimum loan amount of rm5 000 up to maximum rm100 000. Learn more about our loan details interest rate now.