Tenancy Agreement Malaysia Stamp Duty

About chat property malaysia.

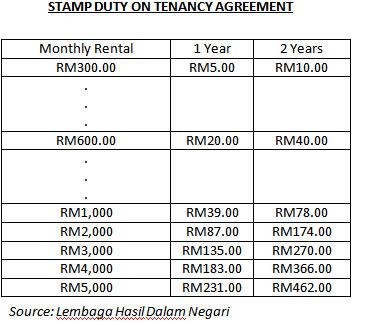

Tenancy agreement malaysia stamp duty. For second copy of tenancy agreement the stamping cost is rm10. In summary the stamp duty is tabulated in the table below. April 1 2019 at 11 27 pm reply. Lease with fixed rent.

Lease or tenancy agreement. 1 year tenancy agreement rm1 for every rm250 of the annual rental above rm2 400. For instance the monthly rental for a one year tenancy is rm2 000 so the annual rent is rm24 000. Pay seller s stamp duty or claim for seller s stamp duty remission for housing developers for agreements relating to disposal of properties.

I got the following table from the lhdn office. The stamp duty is free if the annual rental is below rm2 400. Total cost involved for tenancy period of 1 year diy tenancy agreement stamp duty stamping for 2nd copy rm120 rm10 rm130. Tenancy agreement legal fee and stamp duty calculation in malaysia november 6 2019 august 17 2020 alicia 2 comments charges kuala lumpur malaysia tenancy agreement tenancy agreement is very important for both of the landlord and tenant.

You may check with tax office for clarification. You also need to make sure you know about two additional fees that come with the renting process the stamp duty fees and administration charges for a tenancy agreement. Instruments liable to stamp duty are those listed in the first schedule of the stamp act 1949 exemptions relief from stamp duty general exemptions under section 35 in first schedule stamp act 1949 and specific exemptions under item 2 4 and 32 in first schedule stamp act 1949. And if the tenancy agreement has been signed for more than 3 years the stamp duty rate will be rm3 for every rm250 of the annual rent in excess of rm2 400.

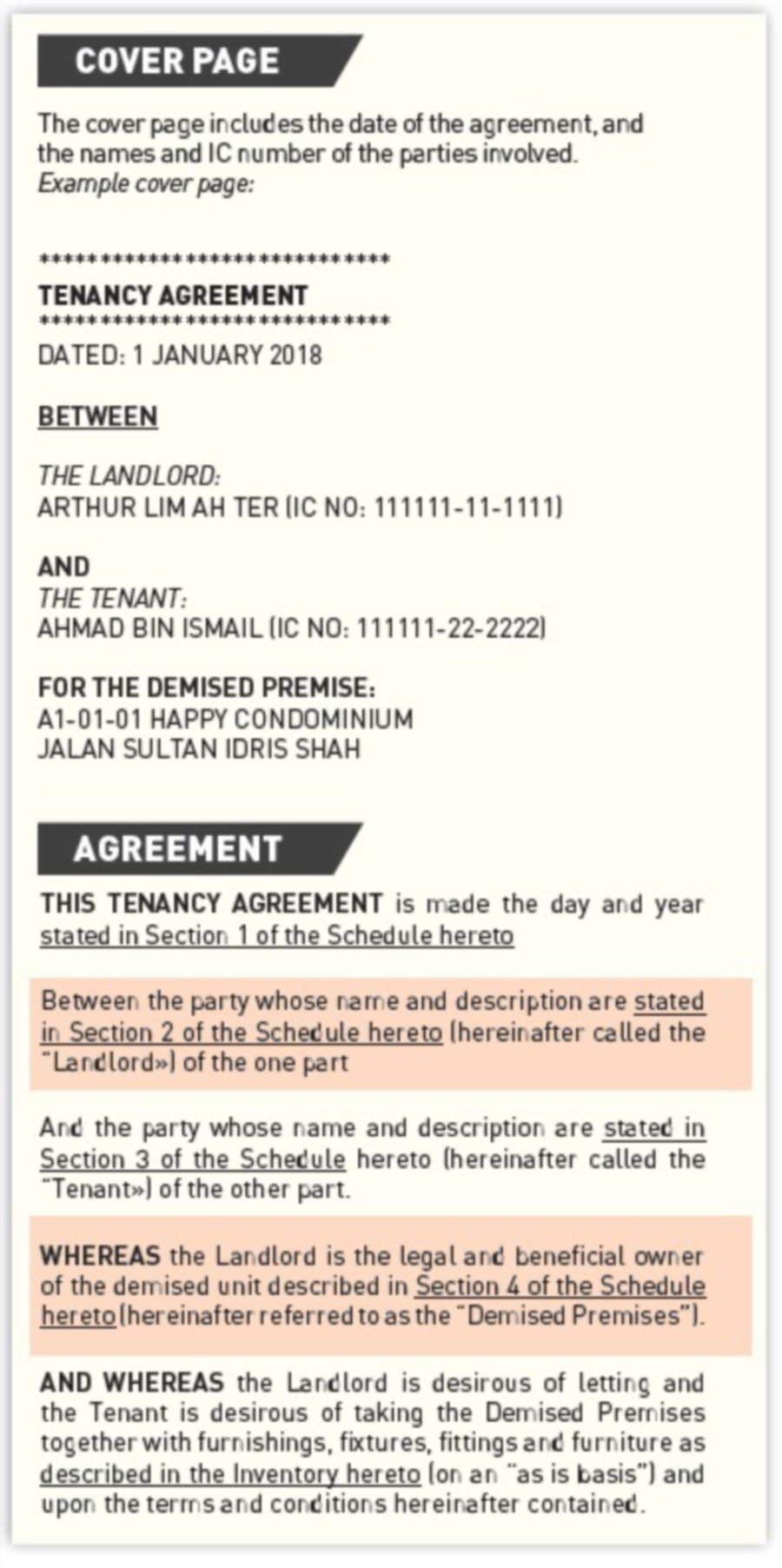

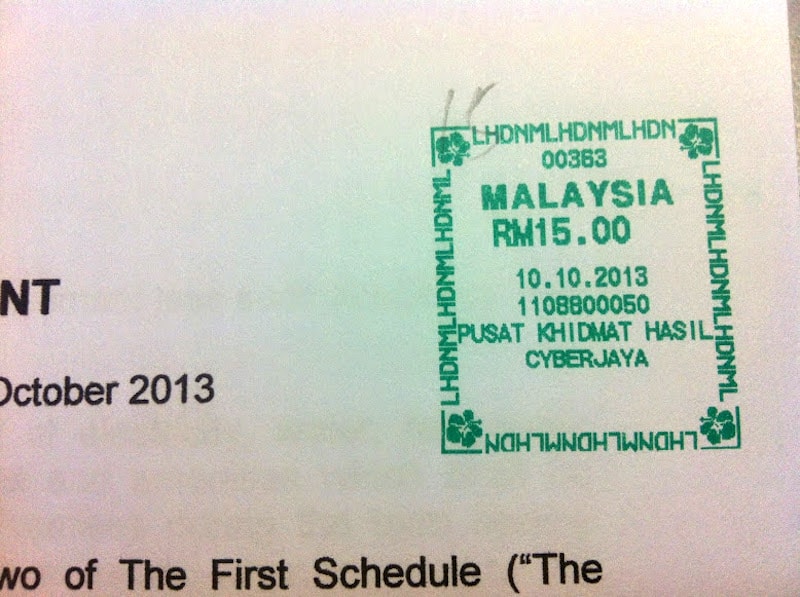

Propertyguru tip the stamping is to make the tenancy agreement legal and admissible in court and is done by the inland revenue board of malaysia lhdn. April 17 2019 at 1 33 pm reply. Sale purchase of property seller s stamp duty note. Tenancy period 3 years payable stamp duty rm30 000 rm250 x rm4 120 x rm4 rm480 figures will be rounded up step 4.

The stamp duty for a tenancy agreement in malaysia is calculated as the following. Stamp duty payable 0 4 of the rent for the extended period from 1 jan 2021 31 mar 2021. Stamp duty is computed based on the consideration paid or the market value of the property whichever is the higher amount. As for the tenancy agreement stamp duty the amount you have to pay is depending on yearly rental and duration of the agreement.

The stamp duty for a tenancy agreement is payable by the tenant whereas the copy is payable by the landlord. Chat property malaysia author.