Stamping Tenancy Agreement Malaysia

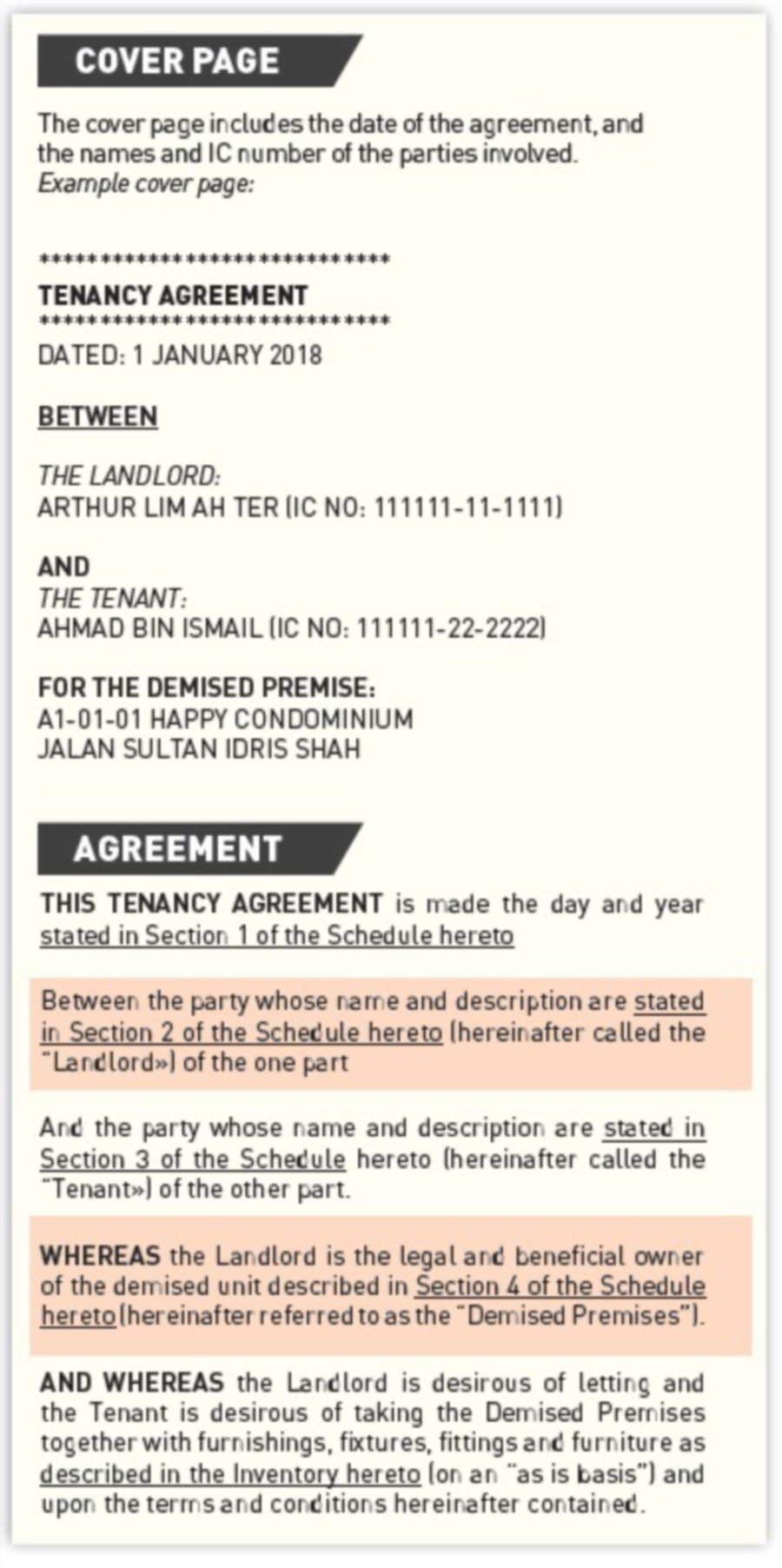

The tenancy agreement will only be binding after it has been stamped by the stamp office.

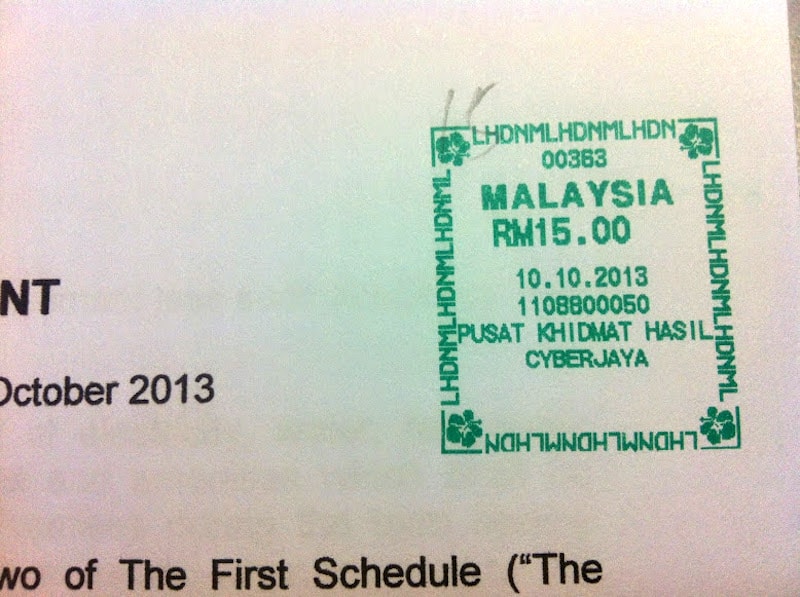

Stamping tenancy agreement malaysia. The malaysia inland revenue authority also known as lembaga hasil dalam negeri malaysia lhdn malaysia is where you pay your stamp duty and may get stamping on your tenancy agreements done. Usually the landlord will arrange for the stamping of the tenancy agreement. E stamping is a secured portal for you to view and manage your stamp duty transactions with iras at your convenience. Prepared two copies of tenancy agreement and duly signed by both tenant and landlord.

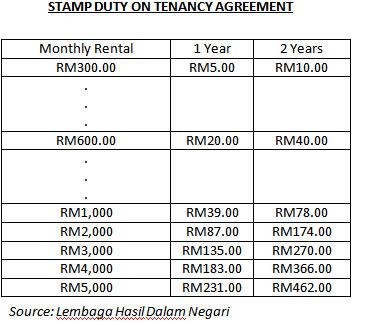

The standard stamp duty chargeable for tenancy agreement are as follows rental for every rm 250 in excess of rm 2400 rental. Rental fees stamp duty and tenancy agreements can be confusing to anyone moving in or leasing a property. So far i have been only 3 lhdn offices namely. Pds 1 and pds 49 a.

We recommend you to download easylaw phone app calculator to calculate it easily. The stamp duty for a tenancy agreement is payable by the tenant whereas the copy is payable by the landlord. An instrument is defined as any written document and in general stamp duty is levied on legal commercial and financial instruments. Go to your nearest lembaga hasil dalam negeri office which is the same place where we submit our income tax.

Faq on tenancy agreement who prepares the tenancy agreement. The person liable to pay stamp duty is set out in the third schedule of stamp act 1949. For instance the monthly rental for a one year tenancy is rm2 000 so the annual rent is rm24 000. The amount paid would be calculated based on the annual rent.

About e stamping portal this application is a service of the singapore government. While paying the stamp duty there are 2 application forms which you need to submit. The stamp duty for a tenancy agreement in malaysia is calculated as the following. The stamp duty is free if the annual rental is below rm2 400.

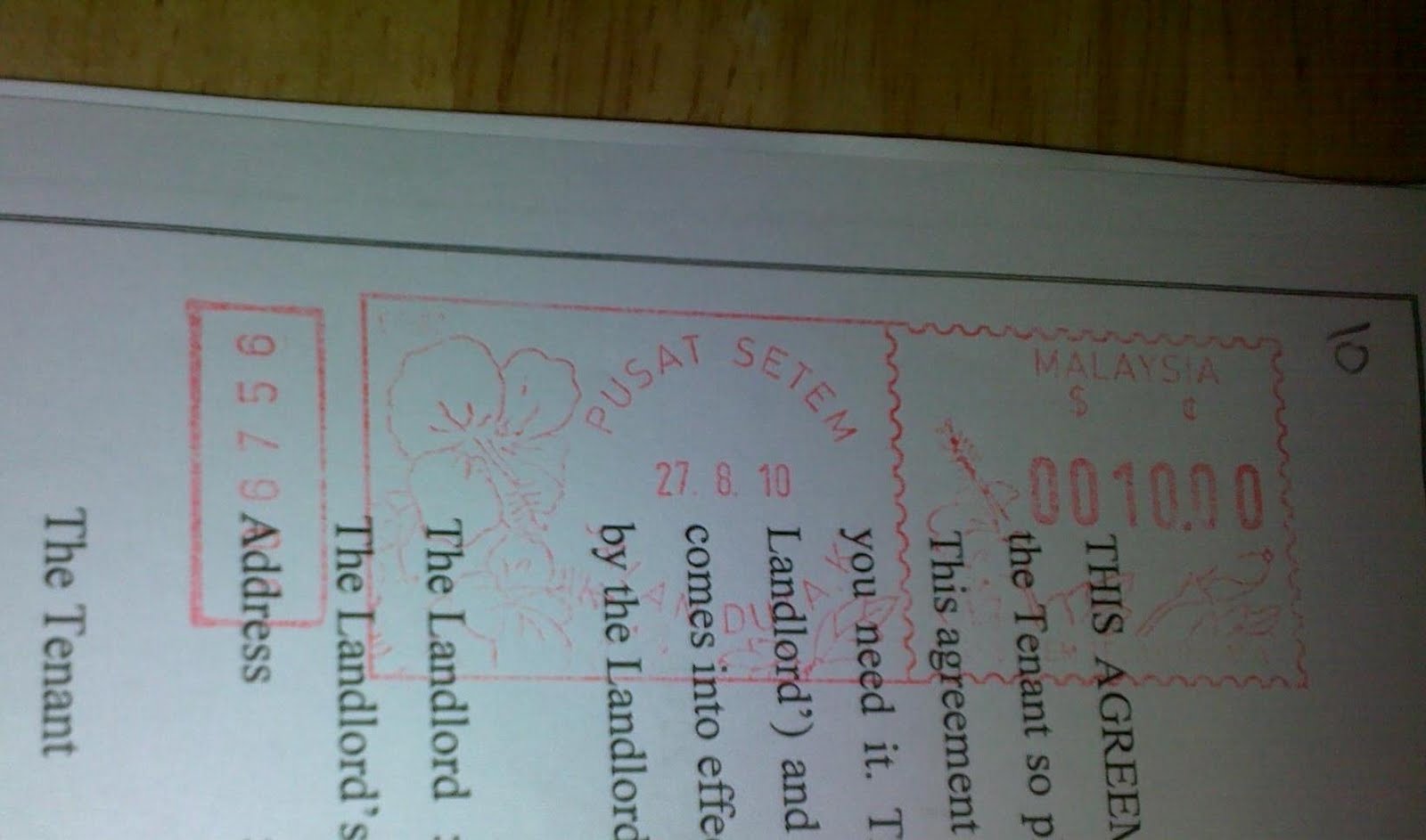

Found out that for the addendum only the nominal rm10 stamping fee is needed. And if the tenancy agreement has been signed for more than 3 years the stamp duty rate will be rm3 for every rm250 of the annual rent in excess of rm2 400. How do i calculate the stamp duty payable for the tenancy agreement. 1 year tenancy agreement rm1 for every rm250 of the annual rental above rm2 400.

Total cost involved for tenancy period of 1 year diy tenancy agreement stamp duty stamping for 2nd copy rm120 rm10 rm130. For second copy of tenancy agreement the stamping cost is rm10. Unless the addendum is to extend the tenancy agreement period or the rental fee is higher than the rental fee originally stated in the agreement in that case you either need to pay according to the formula you shown or pay the differences after an increase in rental.