Sst Exemption List Malaysia

Subscribe to our mailing list for latest updates on the sst malaysia sales and service tax 2018 by clicking the subscribe button below.

Sst exemption list malaysia. Others sales of goods 35. They are liable to register for this service tax under the 2018 act. Certificate of exemption 11. Certificates of exemption are granted to applicants generated through mysst system.

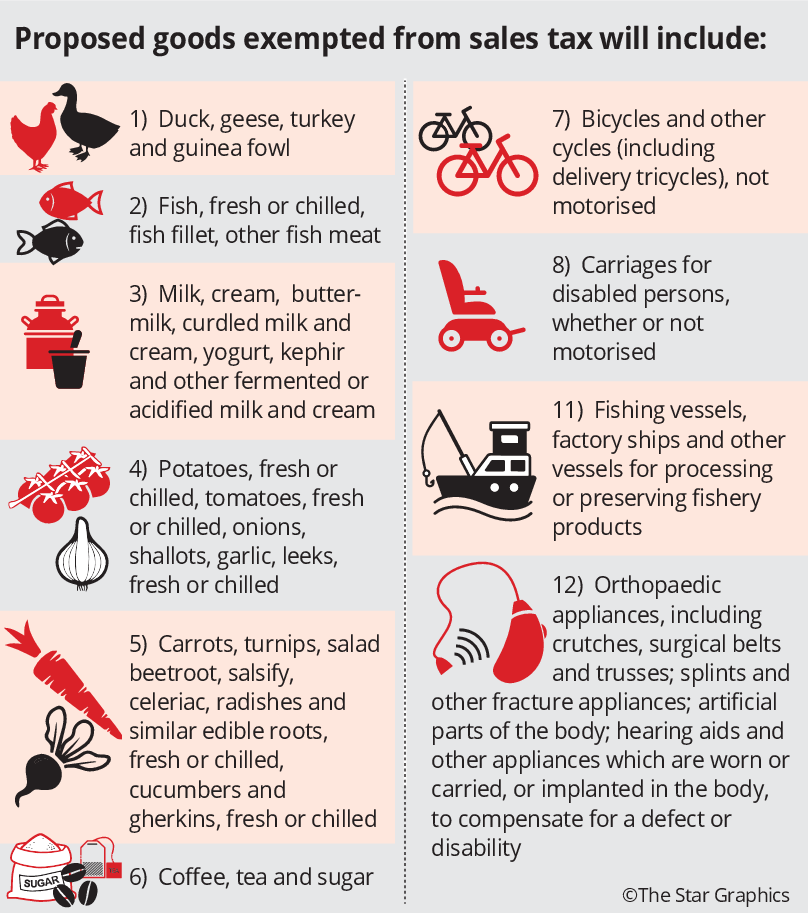

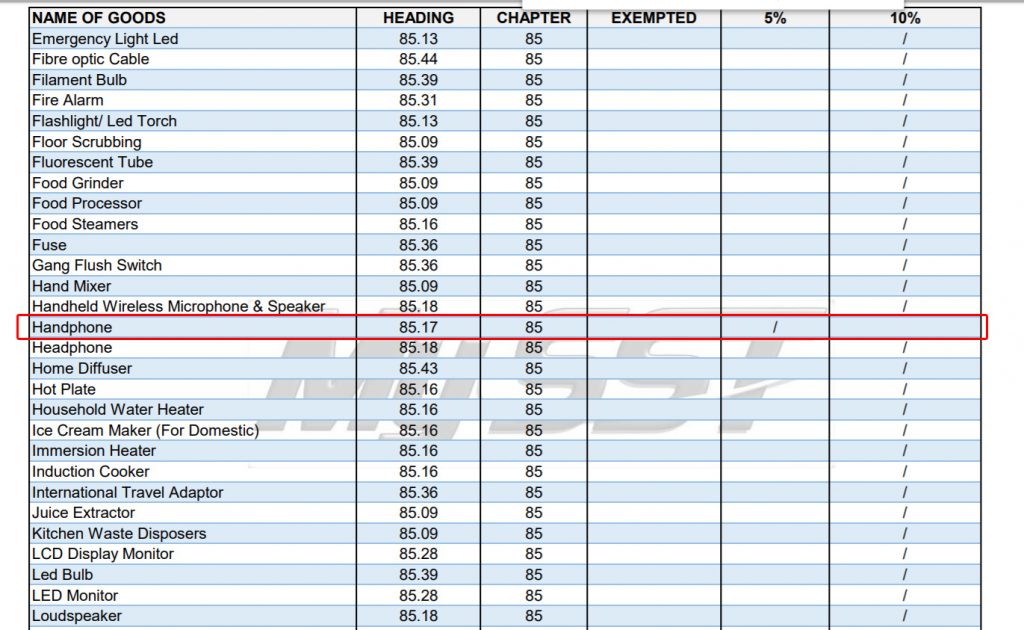

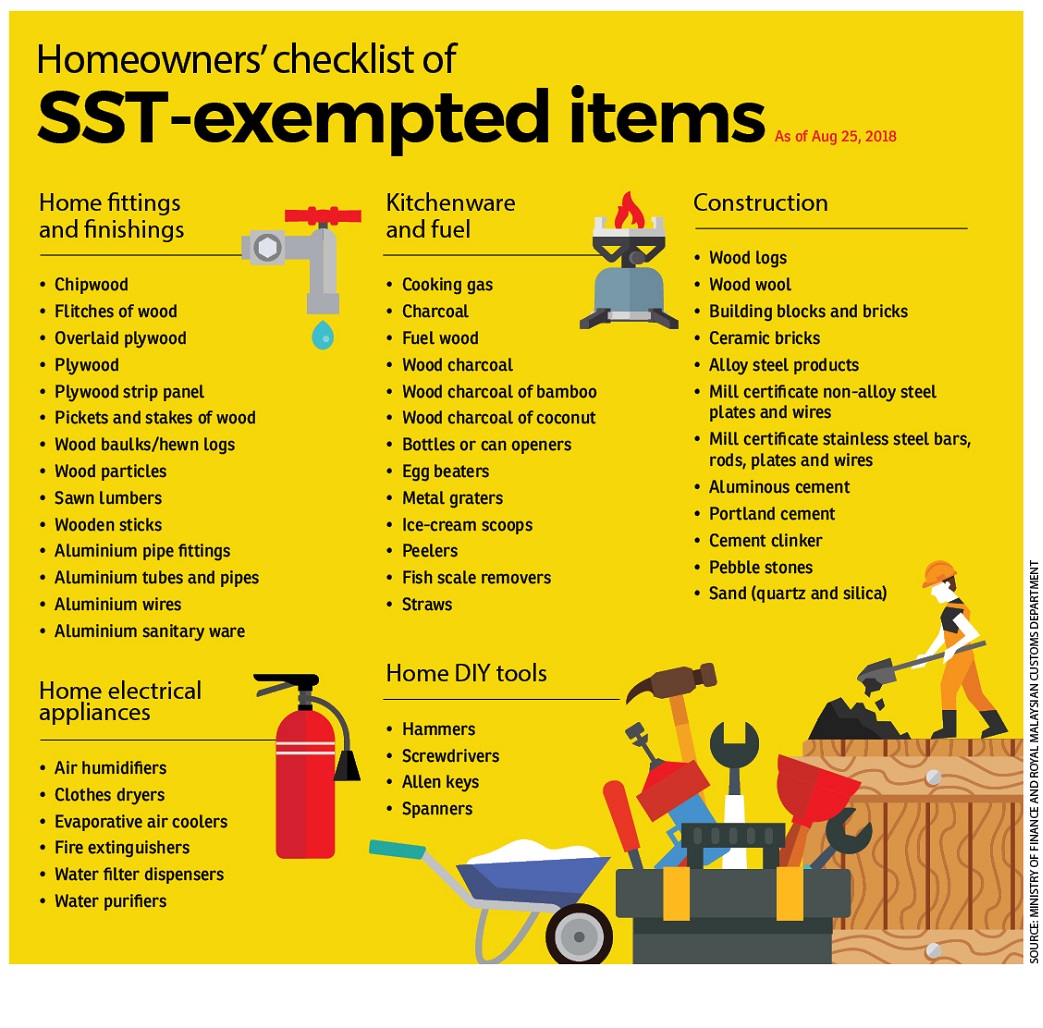

Master exemption list mel and the importer of such items that is petroleum upstream operator will be given an exemption from sales tax subject to prescribed conditions as stated in the sales tax person exempted from sales tax order 2018. Exemption from the sales tax under clause 99 table b sales tax order exemption 1980 is a facility provided for the benefit of local factory operators that manufactures goods that are exempted from the sales tax which are meant for export and also on control items under the ration control act 1961 which is bound under the price control to get taxed raw materials including packaging. Taxable goods refer to all goods manufactured in or imported into malaysia as stated in the sales tax goods exempted from tax order 2018 sales tax exemption from registration order 2018 and sales tax persons exempted from payment of tax order 2018. Manufacturer of specific non taxable goods exemption of tax on the acquisition of raw materials components packaging to be used in manufacturing.

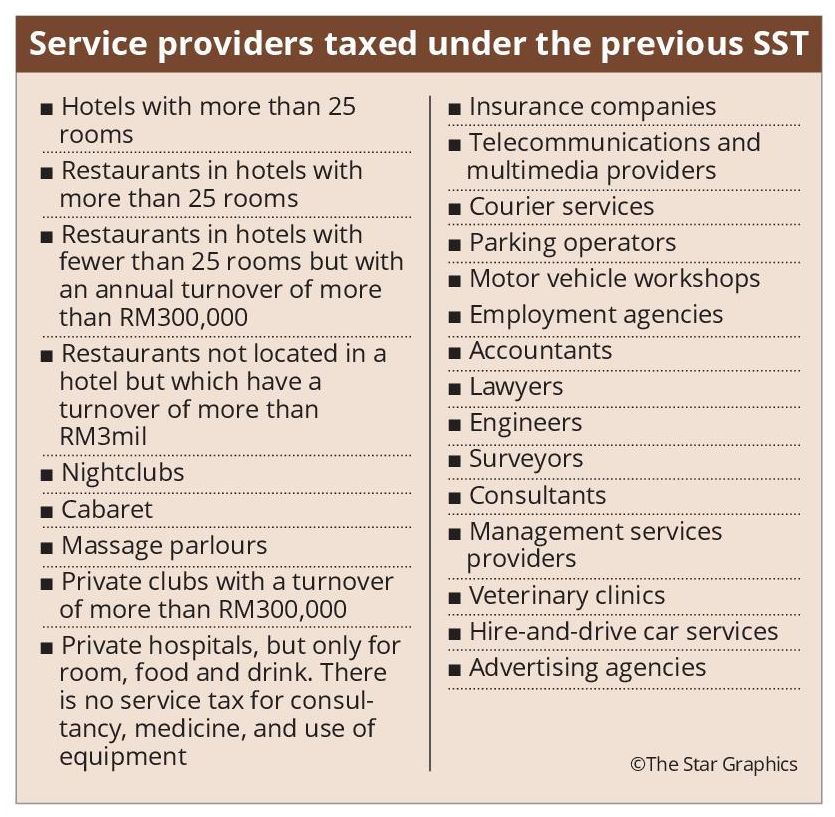

What is the sst treatment on goods delivered after 1st september 2018 and payment. Share mail tweet linkedin print. Now as you have a concept on malaysian service tax let s get back to sst sst or sales and service tax sst in malaysia are generated and goes to the national treasury from the general service providers in malaysia. Following the reduction of sales tax for cars announced by prime minister tan sri.

This website is developed to enable the public to access information related to the royal malaysian customs department includes corporate information organization and customs related matters such as sales and service tax sst. The generated certificate has a certificate number. Exemption and facilities. Sales tax act 2018 a tax to be known as sales tax shall be charged and levied on all taxable goods a manufactured in malaysia by a registered manufacturer and sold used or disposed of by him.

The sst registration threshold is rm1 500 000 for operator of restaurant bar snack bar canteen coffee house or any place which provides food and drinks eat in or take away exclude canteen in an educational institution or operated by a religious institution or body caterer and food court operator. New volkswagen malaysia price list revealed up to rm9 484 or 3 less until dec 31. The exemption from payment of sales tax on such persons and goods will take effect when in respect of.