Ssm Late Filing Penalty

With effect from oct 1 2011 the inland revenue board malaysia has been imposing penalties of up to 35 of the tax payable for late filing of tax returns.

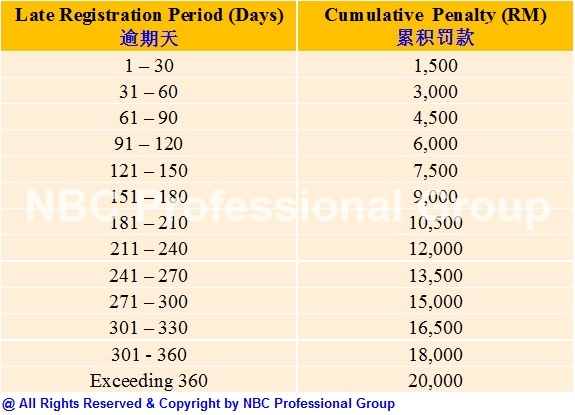

Ssm late filing penalty. Between 61 days to 90 days both days inclusive 100. A sst return is submitted without payment or a lesser payment. A company limited by share b company limited by guarantee. Not more than 30 days.

A late filing fee is a fee imposed on any prescribed forms or returns that are late in its submission deadline to ssm. Maximum penalty is rm3mil. Previous regime penalties are dependent on how late is the filing prior to 1 dec 2015 default of each section will incur a penalty composition sum of between 60 350 depending on the length of default. It is learnt that ssm has been tightening its monitoring and enforcement by imposing severe penalty for late or non submission of annual returns and audited accounts.

Therefore the form or return that is lodge to ssm after the period stipulated by the law or regulation shall be accompanied by the following late lodgement fees late lodgement fees applicable to a private company. Application for incorporation under section 14 of the act. Matter fees rm 1. Filers who access our online filing system bizfile will also be prompted on bizfile on the amount payable.

Late lhdn borang c no tax payable rm 200 with tax payable rm200 10 30 on tax payable. Ssm late filing late audit unknown quite a lot if im not mistaken what you can do is appeal from rm4k per director to a lower penalty income does not affect penalty from ssm. Penalty for late changes. 10 of the amount not paid after the last date of the first 30 days period.

Length of default days late lodgement fee. Agencies under domestic trade and consumer affairs ministry kpdnhep. Under the company law a director can be fined rm30 000 or jailed five years or both if he fails to lodge his company s annual return and audited accounts. Late or non compliance with the requirement for the annual return submission is fined with rm2 000 while non submission of the profit and loss accounts or audited financial statements is penalized with a rm30 000 fine and up to 5 years imprisonment.

.jpg)