Rpgt Rate Malaysia 2018

Disposal date and acquisition.

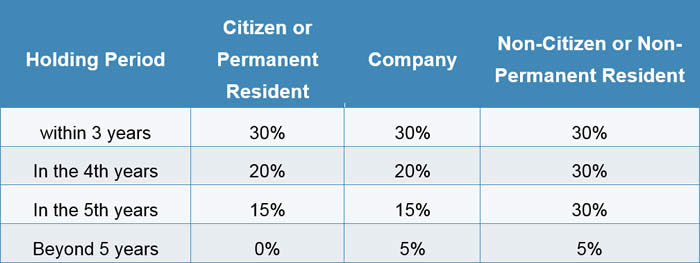

Rpgt rate malaysia 2018. All prices in malaysian ringgit rm myr all price above will subject to malaysia service tax at 6 commencing 1 september 2018. For disposals in the 5th years. Real property gains tax rpgt rates. Disposal date and acquisition.

The rpgt rate for a non malaysian citizen is 30 on the gain if the property acquired is less than five years old and 5 on the gain if the property acquired is more than five years old. Real property gains tax rpgt rates. If you owned the property for 12 years so you ll need to pay rpgt of 5. New section 21b 1a rpgt act 1976 duty of the property buyer to withhold part of the consideration and remit it to inland revenue board of malaysia irb.

Individual citizen pr individual non citizen for disposals within 3 years. Inland revenue board of malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website. If you ve held it for six years you wouldn t have to pay any rpgt at all as the rate for citizens selling beyond five years is 0. With effect from 1 january 2014 for companies and individuals who are malaysian citizens and permanent residents a real property gains tax rpgt rate of 30 will be imposed for a holding period of real property of up to 3 years 20 for a holding period exceeding 3 years and up to 4 years and 15 for a holding period exceeding 4 years and up to 5 years.

Above rpgt rates in malaysia as of budget 2014 in the announcement of budget 2014 every property owners have to pay rpgt at a 30 for properties sold within 3 years or less 20 for properties disposed within 4 years and 15 for properties disposed in 5 years. 29 january 2018 malaysia s robust online tax platform keeps getting better the malaysian reserve 26 january 2018 2017. The rpgt exemptions you should know about. For disposals in the 6th and subsequent years.

Semua harga di atas akan dikenakan cukai perkhidmatan malaysia pada 6 bermula 1 september 2018. Among the exemptions are. The effective rpgt rates are as follows. Calculations rm rate tax rm 0 5 000.

There are some exemptions allowed for rpgt. You ll pay the rptg over the net chargeable gain. Tax payable net chargeble gain x rpgt rate based on holding period rm171 000 x 5 rm8 550. Rm 50 000 rm 250 000 x 20 if however you decided to sell in the fifth year it would only be rm 37 500 as the rgpt drops down to 15.

Corporate tax rates for companies resident in malaysia is 24. What is the rpgt rates in malaysia.