Real Property Gain Tax Malaysia

This fact is specified in the real property gains tax act 1976 act 169.

Real property gain tax malaysia. It is chargeable upon profit made from the sale of your land or real property where the resale price is higher than the purchase price. Rpgt is a tax that is charged only when you sell a piece of property. It includes both residential and commercial properties estates and an empty plot of lands. 7 november 1975 be it enacted by the seri paduka baginda yang di pertuan.

Which means that if one day you decide to sell your house you have to pay taxes on the profit gains if you have any. Sort of but not exactly. Real property gain tax or in malay is cukai keuntungan harta tanah ckht is a tax imposed on gains derived from the disposal of properties in malaysia. In malaysia rpgt is a tax imposed by the inland revenue board lhdn on chargeable gains which find their source in the disposal of real property.

So basically it s a capital gains tax with a different name. Rpgt is imposed as a result of the profits made from the difference between the disposal price and acquisition price. What is real property gain tax rpgt. A real property gains tax rpgt is the imposition of tax on your profits from selling a property.

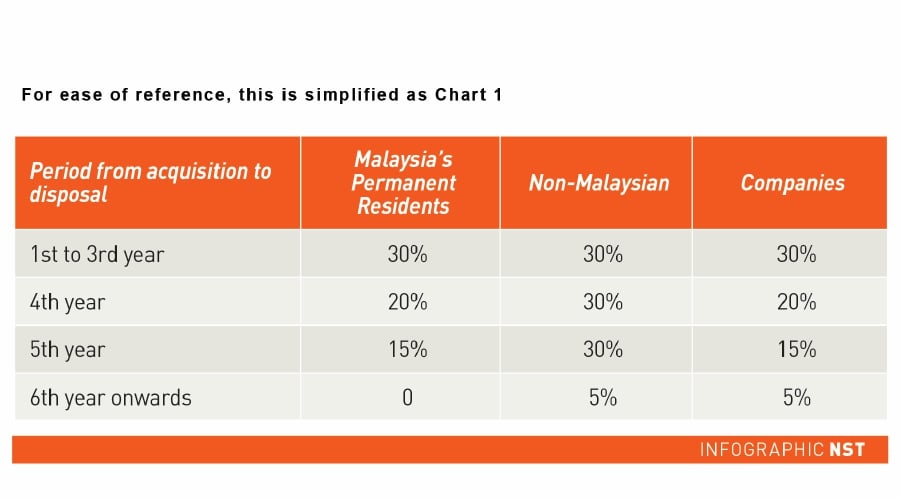

Whether you are a malaysian citizen a foreign resident a. Real property gains tax. Real property gains tax or rpgt is one tax that can make or break your investment earnings. Real property gains tax rpgt is a form of capital gains tax that homeowners and businesses have to pay when disposing of their property in malaysia.

Laws of malaysia act 169 real property gains tax act 1976 an act to provide for the imposition assessment and collection of a tax on gains derived from the disposal of real property and matters incidental thereto. Rpgt is charged on the net gains of the sale of your property. According to the real property gains tax act 1976 rpgt is a form of capital gains tax in malaysia levied by the inland revenue lhdn. It is the tax which is imposed on the gains when you dispose the property in malaysia.

The tax is payable by the seller of the property and it s payable to malaysia s inland revenue board or lembaga hasil dalam negeri in malay frequently abbreviated to lhdn. The exemption is limited to the disposal of 3 units of residential property for each disposer. In simpler terms if you own a house and plan to sell it one day you will have to pay tax to the government for the gains a k a profits you re going to receive. In its simplest form it s basically a tax charged on the capital gain or net profit a seller makes when he or she sells a property.