Personal Loan Bank Islam 2018

Bank islam personal financing i package with fixed rate ditawarkan kepada pemohon yang berumur 18 tahun ke atas dengan pendapatan gaji kasar bulanan tidak kurang daripada rm2 000 atau tahunan rm24 000.

Personal loan bank islam 2018. The bank islam personal loan offers either fixed or floating interest rates. Product disclosure sheet personal financing i sales bank islam malaysia berhad bu pds personal financing i sales version 1 0 2018 the bank such as property machinery etc may be foreclosed repossessed and you are to bear all costs incurred in the disposal of the asset. Personal financing i non package. Bank islam malaysia berhad jawi.

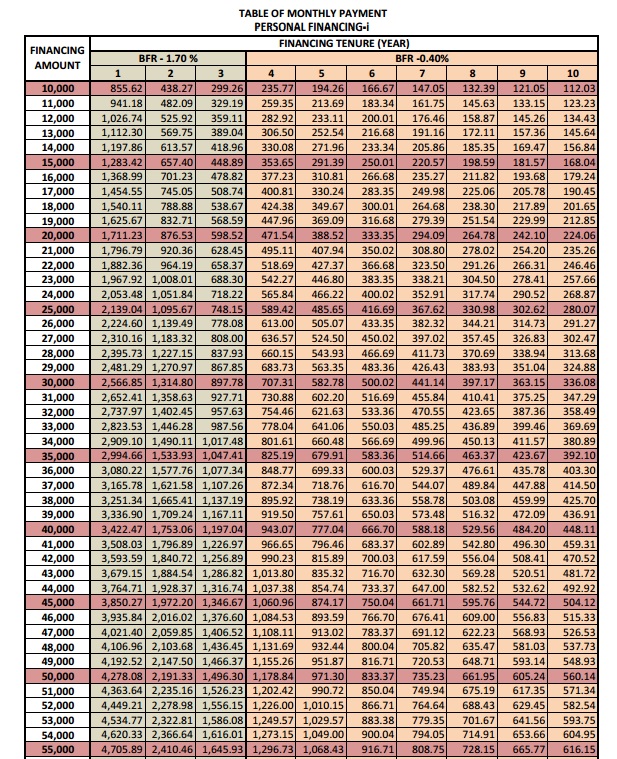

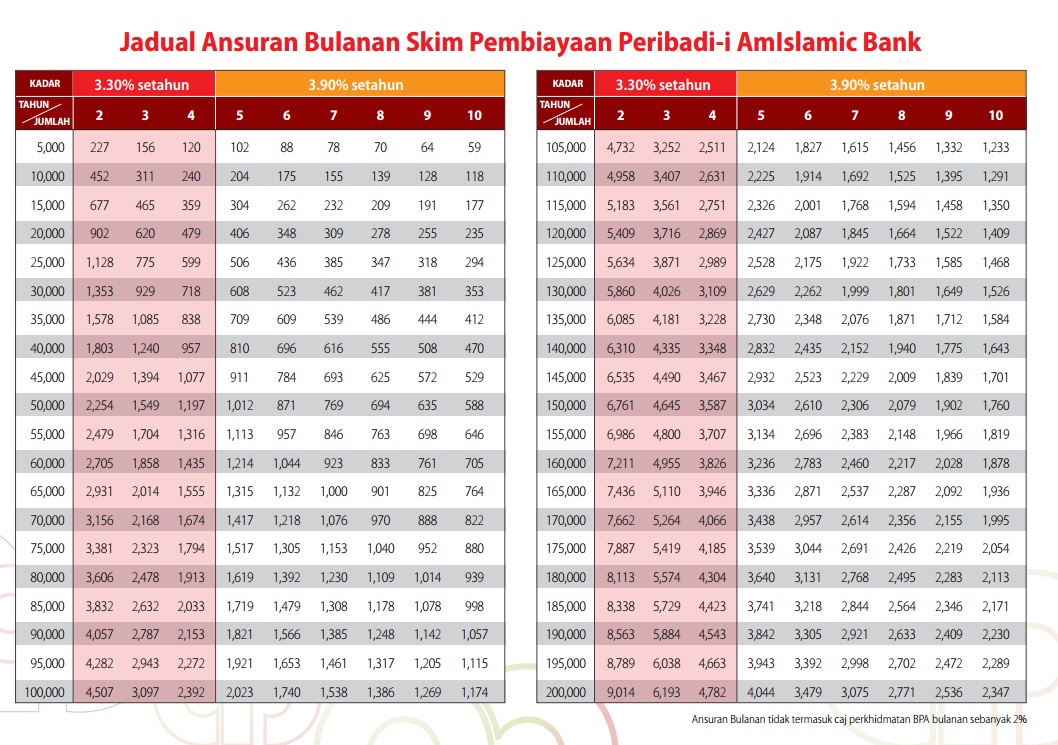

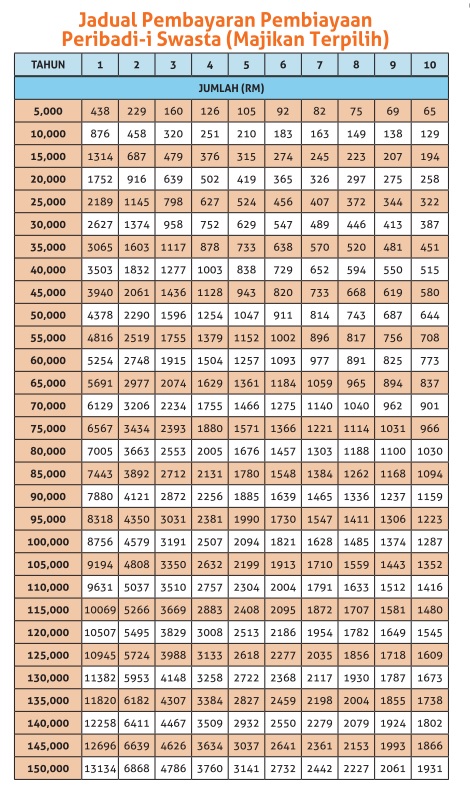

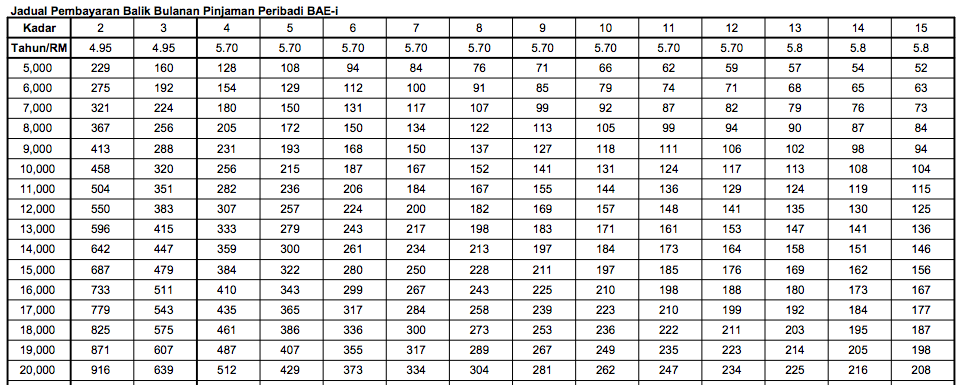

Bank islam debit card i. For the repayment for bank islam personal financing i it can be done via auto salary deduction or salary transfer directly to bank islam. This personal loan has a maximum tenure of 10 years. The maximum deductable would be 50 to 60 of salary.

بڠك اسلام مليسيا برحد is an islamic bank based in malaysia that has been in operation since july 1983. The personal loan also comes with a minimum income requirement of rm1 500. The payment for bank islam personal financing i is done via auto salary deduction or salary transfer to bank islam. Form programs for bank islam card i.

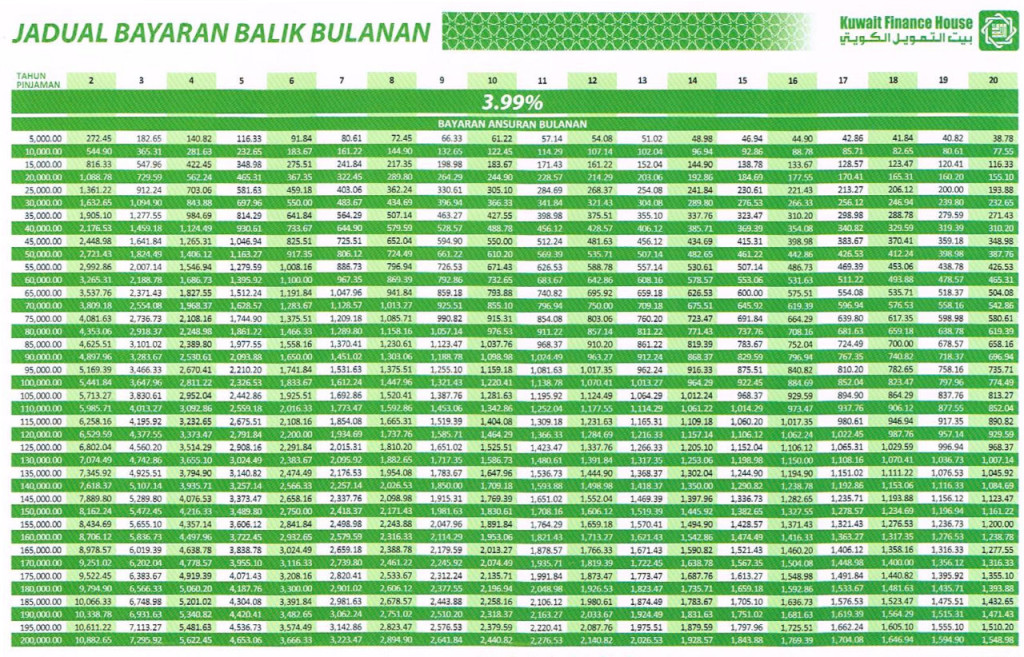

It has a maximum tenure of 10 years. Bank islam personal financing i package with bank islam personal financing i package the personal loan comes with an fixed interest rate starting from 4 9 p a. Syarat kelayakan yang ditetapkan oleh pihak bank islam untuk mohon pelan pembiayaan ini tidak membebankan. The bank islam personal financing i offers a minimum loan amount of rm10 000 and a maximum loan amount of rm200 000.

This product is based on the mode of diminishing musharakah. In order to be eligible for the bank islam personal loan you should be a malaysian citizen 18 years old and above and have a stable job position with a government sector or a glc with a minimum monthly income of rm2000. The profit rate used to calculate the monthly rentals is1 year kibor 3 5. Guide for consumer on.

You are also responsible to settle any shortfall after the asset. List of campaign winners. Bank islam credit card i. Bank islam was established primarily to assist the financial needs of the country s muslim population and extended its services to the broader population.

The bank will only finance the outstanding principal and not the markup. There are no processing charges when you apply for the loan however there will be a rm 50 chargeable wakalah fees for this product.