Personal Loan Affin Bank

Rm1 000 rm25 000 total commitments.

Personal loan affin bank. Bank islam flat rate personal financing i package. This is a clean and unsecured islamic personal financing based on the tawarruq contract offered to eligible borrowers for personal consumption and not for luxurious purposes. Invest unit trust asnb. Loan vehicle property loans.

Contact centre 03 8230 2222. Rm2 000 per month after debt consolidation. Is an affin bank housing loan right for me. Tell me about this islamic personal loan by affin islamic bank.

Contact centre 03 8230 2222. Protect life general vehicle insurance. Invest unit trust asnb. Personal loan from bank b.

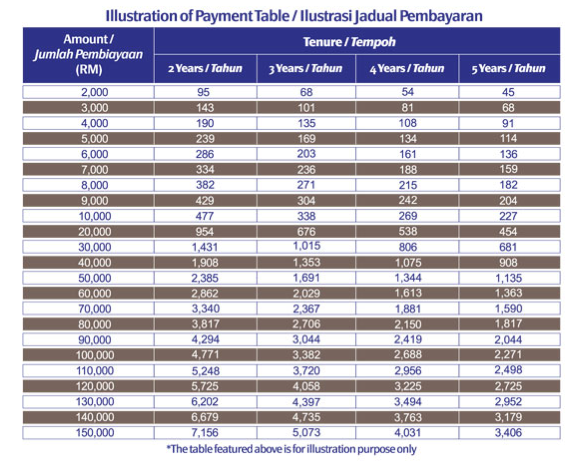

Affin bank personal loan posted on january 9 2019 by admin the personal financing is a great loan package that fully based on sharia concept and it is suitable for anyone working at a selected panel of companies. Affin islamic bank requires you to disclose the purpose of financing in the application form. Tenure over 2 years monthly repayment rm462 50. Salaried customer in private sector.

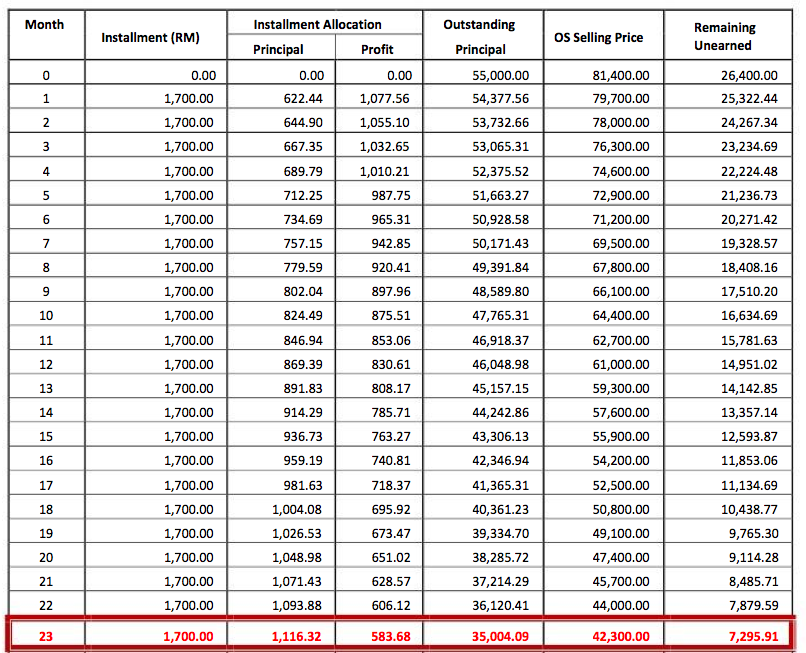

Nonetheless the bank is effectively operating as a standalone islamic bank on april 1 2006 after it was incorporated as a separate entity for the islamic banking division of affin bank in 2005. You can expect an early settlement penalty equal to 5 of the outstanding loan amount if you repay your loan or refinance within the first 3 years and 3 for the subsequent 2 years. Affin islamic personal financing i profit rate from 5 5 p a. Affin bank housing loans come with a lock in period of 5 years which is among the longest among banks in malaysia.

Affin islamic bank better known as affin islamic was launched on 1993 that closely affiliate with affin bank berhad affin bank as an islamic banking. Rm500 rm10 000 personal loan from bank c. Pensioners under the government pension scheme a pension payment credited into pensioner s bank account. Affin islamic personal financing i is a shariah compliant unsecured term financing to meet personal financial needs which is calculated based on either a fixed rate or variable rate.

Spend credit debit cards.