Malaysia Gst Tax Code 2017

Pwc 2016 2017 malaysian tax booklet contents type of supplies supply of goods and services relief from charging or payment of gst special schemes free zones designated areas recovery of input tax time limit for making claim of input tax tax invoice records and retention period returns penalties other duties import duties export duties excise.

Malaysia gst tax code 2017. This booklet is a general guide on goods and services tax gst. The goods and services tax gst is an abolished value added tax in malaysia. Malaysia gst reduced to zero. Berikutan pemansuhan akta cukai barang dan perkhidmatan 2014 akta 762 yang berkuat kuasa pada 1 september 2018 semua urusan permohonan rayuan cukai barang dan perkhidmatan cbp telah dipindahkan di bawah bidang kuasa tribunal rayuan kastam kementerian kewangan malaysia.

Apa apa permohonan rayuan cbp. The existing standard rate for gst effective from 1 april 2015 is 6. 11 minutes to read. Of his expertise is accounting software tax codes usage and gst audit file gaf.

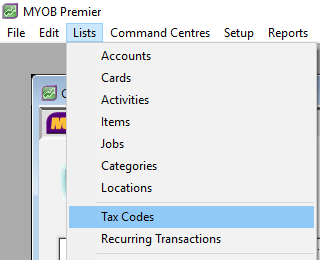

Attention please be informed that this portal will remain active until further notice. Tax code description gst 03 os txm 0 this refers to out of scope supplies made outside malaysia which will be taxable if made in malaysia. It is part of a series of educational materials made available to help businesses and. This topic provides information that will help you set up goods and services tax gst for a malaysian company.

In the latter part of june 2017 the gst provision of information regulations 2017 was enacted and came into force on the 1 july 2017. Malaysia goods and services tax. The ministry of finance mof announced that starting from 1 june 2018 the rate of the goods and service tax gst will be reduced to 0 from the current 6 for more information regarding the change and guide please refer to. Tax code for supplies 9 codes 9 1 tax code for purchas es 14 codes 14 tax code for supplies 10 codes 10.

4 1 gst was introduced with effect from 1 4 2015 under the gsta. Malaysia if the provider of the services belongs in malaysia. Gst is an indirect tax on domestic consumption of goods and services rendered in malaysia and importation of goods and services. As at 24 august 2017 iii.

Gst is a multi stage tax and payment is made in stages by the intermediaries in the production and distribution process. Gst is to be charged. The out of scope supply must comply with malaysia. The customs department has launched its latest compliance drive called customs blue ocean strategy cbos 3 0 that runs until dec 31 2017.

2 tax code on adjustme.