Malaysia Corporate Tax Rate 2018

Some of the major tax incentives available in malaysia are the pioneer status ps investment tax allowance ita and reinvestment allowance ra.

Malaysia corporate tax rate 2018. Definition the malaysian corporate income tax for legal entities incorporated companies other corporate associations of individuals and unincorporated businesses is a specific form of income tax and can be partly compared to the german corporate income tax körperschaftssteuer. Malaysia has adopted a territorial system to pay corporate tax rate. This page is also available in. Malaysia adopts a territorial system of income taxation a company whether resident or not is assessable on income accrued in or derived from malaysia.

Malaysia taxation and investment 2018 updated april 2018 1 1 0 investment climate 1 1 business environment malaysia is a federated constitutional monarchy with a. The corporate tax rate in malaysia stands at 24 percent. Malaysia corporate tax rate 2018. 2018 2019 malaysian tax booklet 22 rates of tax 1.

Resident individuals chargeable income rm ya 2018 2019 tax rm on excess 5 000 0 1 20 000 150 3 35 000 600 8 50 000 1 800 14 70 000 4 600 21 100 000 10 900 24 250 000 46 900 24 5 400 000 83 650 25 600 000 133 650 26 1 000 000 237 650 28 a qualified person defined who is a. The current cit rates are provided in the following table. Chargeable income myr cit rate for year of assessment 2019 2020. An organization or corporate regardless of whether occupant or not is assessable on wage gathered in or got from malaysia.

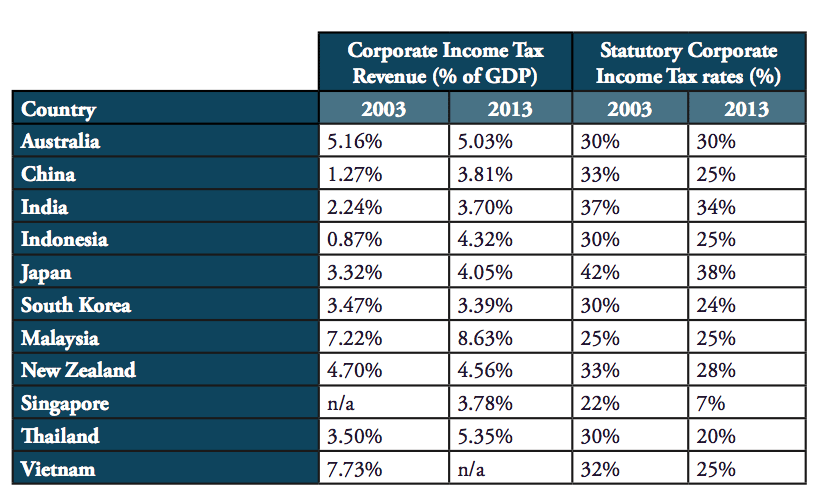

Jadual average lending rate bank negara malaysia seksyen 140b sekatan ke atas kebolehpotongan faedah seksyen 140c akta cukai pendapatan 1967 edisi bahasa inggeris sahaja study group on asian tax administration and research sgatar. Corporate tax rate in malaysia averaged 26 21 percent from 1997 until 2020 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015. The standard corporate tax rate of 24 for a period of five years with a possible extension for. Corporate income tax in malaysia as of july 2018 1.

For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 7 2 as only 30 of its profits are subject to tax. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar. For both resident and non resident companies corporate income tax cit is imposed on income accruing in or derived from malaysia.