Malaysia Airlines Financial Problems

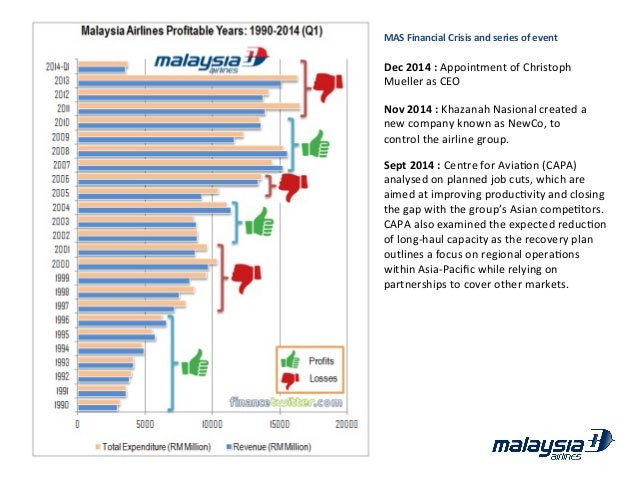

Malaysian airlines has made a financial loss every year since 2011.

Malaysia airlines financial problems. Malaysia airlines had already been in a horrible financial situation before 2014 and that was made significantly worse after they lost two 777s just months apart. But 2020 has brought the airline s financial problems to the fore. Malaysia airlines wrote to lessors saying the airline was burning through 84 million a month and had only 88 million in available liquidity and a further 139 million from khazanah nasional berhad it could draw against. According to the letter the aviation group was experiencing an average monthly operating cash burn of 84m but only had 88m in liquidity up to august 31 and an additional 139m available.

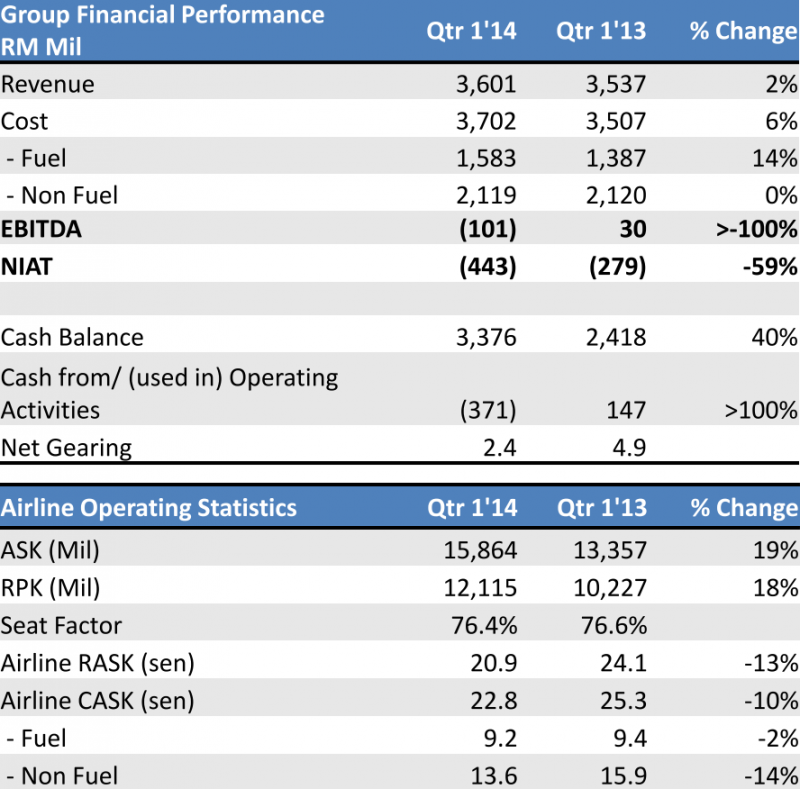

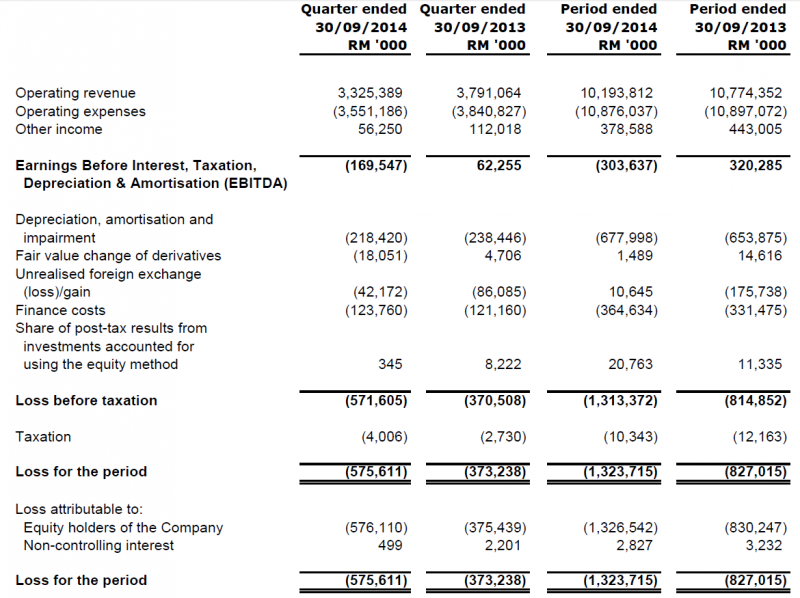

The profit for malaysia airlines decrease sharply because cannot cover the cost of running the airlines. The cost for running the airlines are very large unable to cover the losses that will bring a huge financial problem to them. The latest financials are suggesting that malaysia airlines will be operating at a loss. It has lost rm2 35 billion between 2015 and 2017.

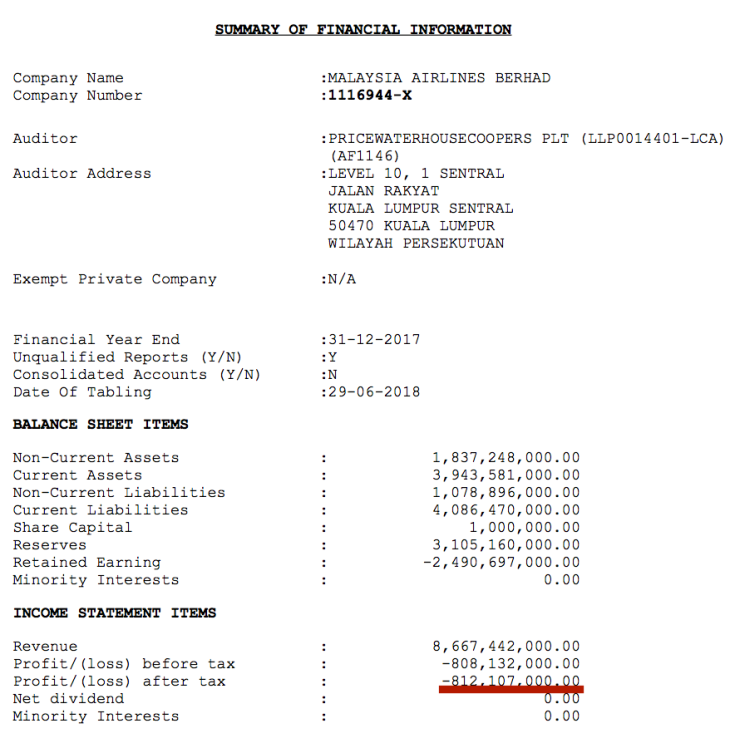

Our performance last year was hampered by an adverse exchange rate swing which saw the depreciation of the malaysian ringgit rm against the us dollar usd. Reports indicate that if the flag carrier of malaysia can t turn its situation around or find a major investor it will require up to rm21 billion us 5 15 billion of government assistance in order to keep it going until 2025. In early october malaysia airlines ceo warned the airline could shut down if lessors rejected a restructuring plan. Filings with the companies commission of malaysia ssm show that malaysia airlines net loss increased by 85 year on year to rm812 11 million for the financial year ended dec 31 2017 fy2017.

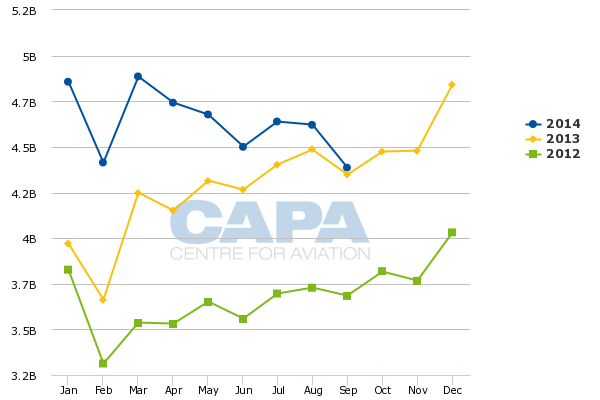

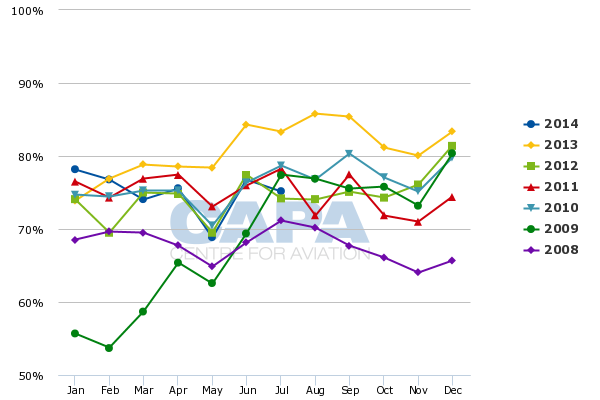

Its last quarterly results were revealed in november 2014 as it delisted from the stock exchange when sovereign wealth fund. 3 0 financial problem 3 1 malaysia airlines financial crisis very low yield graph 1 the average fares were unable to cover the cost of running the airline. For the most part the airline has been headed in the right direction. With more than 50 of our cost structure in usd the depreciation had a significant impact on the company s overall financial performance.