Lhdn Tenancy Agreement Stamp Duty

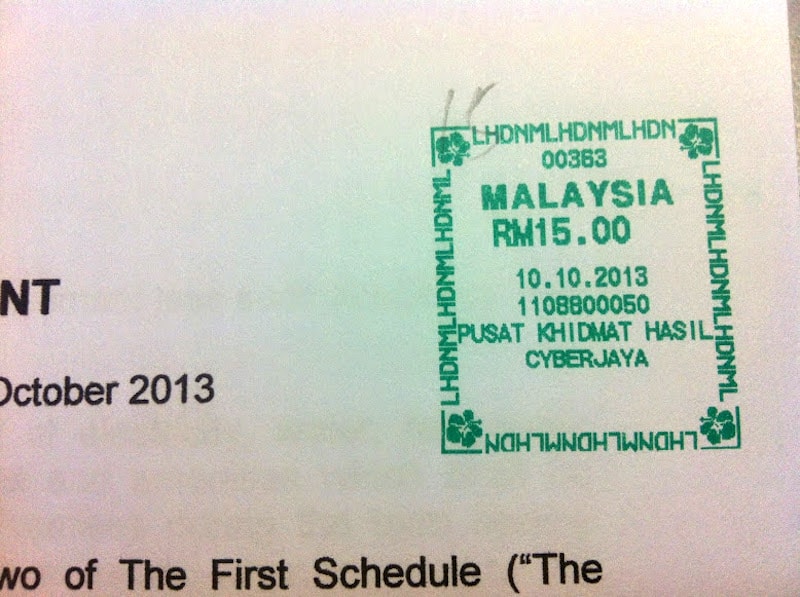

The malaysia inland revenue authority also known as lembaga hasil dalam negeri malaysia lhdn malaysia is where you pay your stamp duty and may get stamping on your tenancy agreements done.

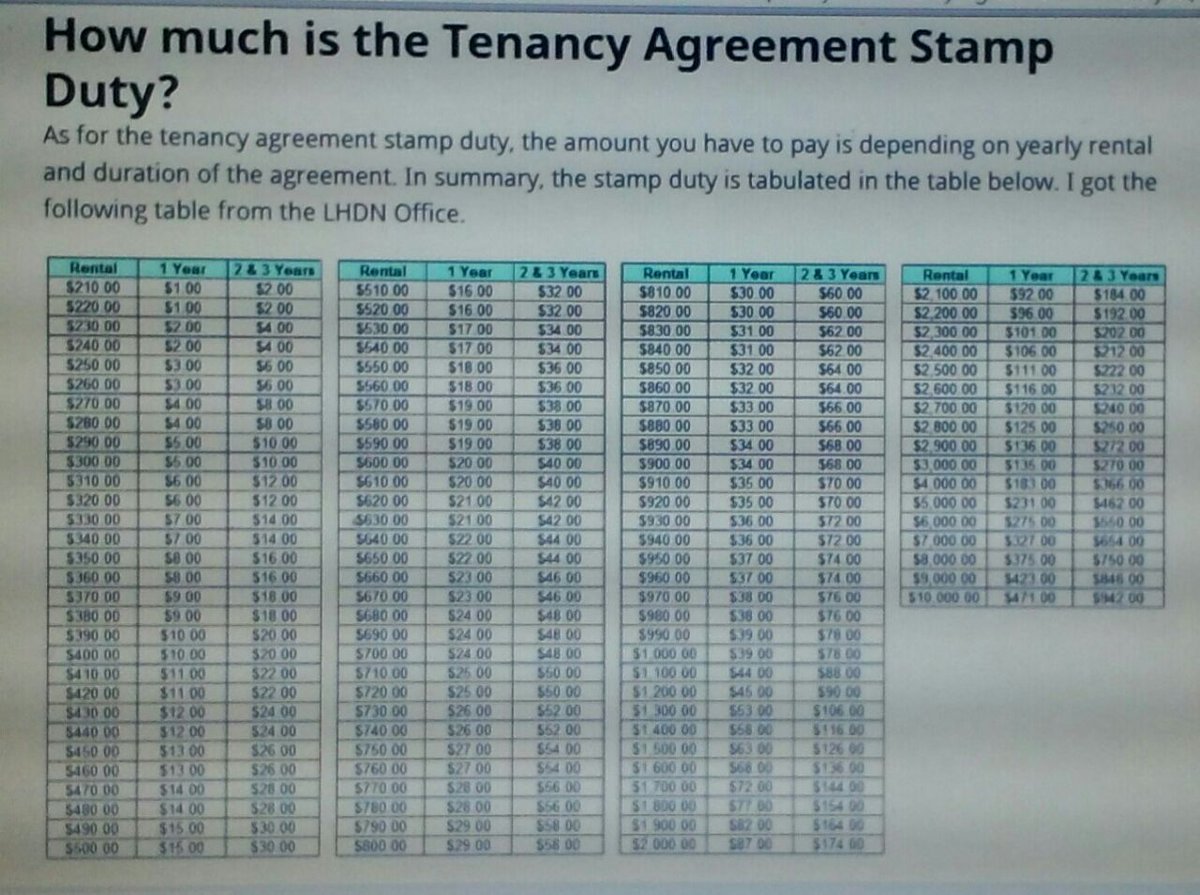

Lhdn tenancy agreement stamp duty. Enter the monthly rental duration number of additional copies to be stamped. 12 december 2020. It s sort of like paying income tax for income but now you re paying tax for an agreement. In summary the stamp duty is tabulated in the table below.

How much is the tenancy agreement stamp duty. Admin posted on. A tenancy agreement is a printed document that indicates all the terms and conditions agreed by the tenant and the landlord before the tenant arrives. Lhdn tenancy agreement stamp duty form.

The malaysia inland revenue authority also known as the lembaga hasil dalam negeri malaysia lhdn malaysia is where you can pay your stamp duty and perhaps get stamps on your leases. One for the tenant one for the landlord and another for the real estate agent if any. I got the following table from the lhdn office. Instruments liable to stamp duty are those listed in the first schedule of the stamp act 1949 exemptions relief from stamp duty general exemptions under section 35 in first schedule stamp act 1949 and specific exemptions under item 2 4 and 32 in first schedule stamp act 1949.

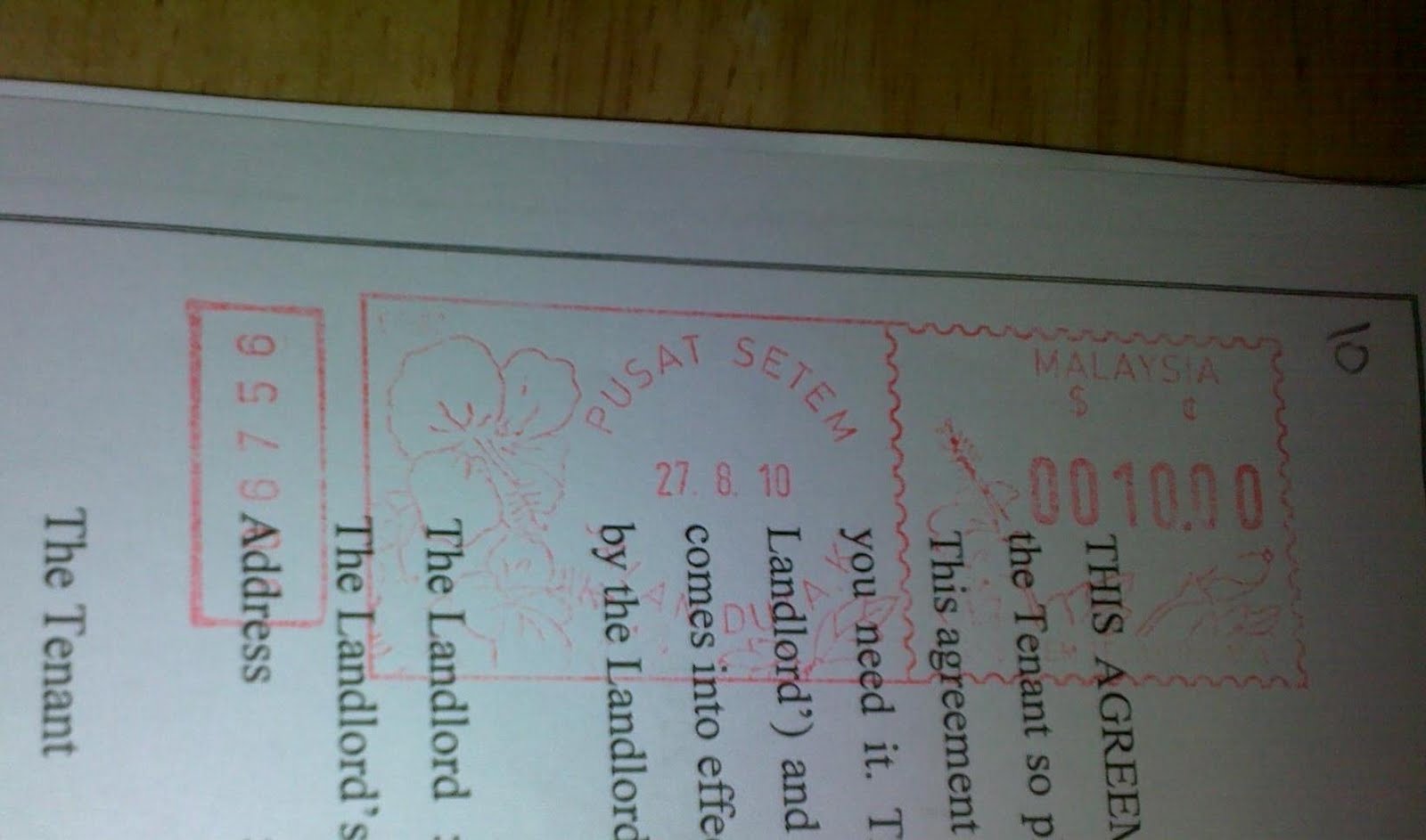

Rental fees stamp duty and tenancy agreements can be confusing to anyone moving in or leasing a property. This method will replace the manual system in lhdnm s counter which use franking machine and revenue stamp. As for the tenancy agreement stamp duty the amount you have to pay is depending on yearly rental and duration of the agreement. This would cover things such as tenancy agreements and land titles and even insurance policies.

It is best to get original stamped copies for each part. Stamps is an electronic stamp duty assessment and payment system via internet. Jika anda pernah mengunakan sistem stamps sebelum ini. For second copy of tenancy agreement the stamping cost is rm10.

Online calculator to calculate tenancy agreement stamp duty. Stamp duty is a tax duty that s imposed on documents that have a legal commercial and financial effect. Lhdn aka the inland revenue board of malaysia.