Lhdn Tenancy Agreement Stamp Duty Calculation

Please input the tenancy details and then press compute.

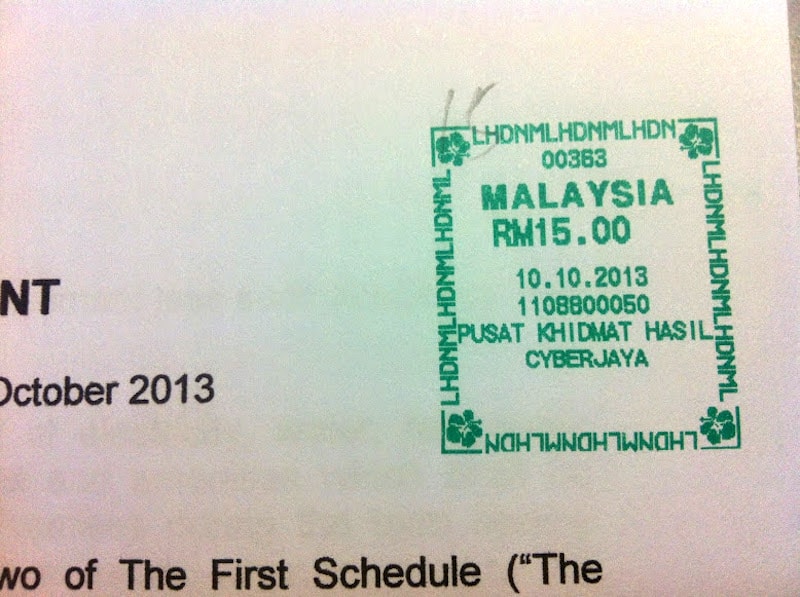

Lhdn tenancy agreement stamp duty calculation. This method will replace the manual system in lhdnm s counter which use franking machine and revenue stamp. The malaysia inland revenue authority also known as lembaga hasil dalam negeri malaysia lhdn malaysia is where you pay your stamp duty and may get stamping on your tenancy agreements done. To use this calculator. Rental fees stamp duty and tenancy agreements can be confusing to anyone moving in or leasing a property.

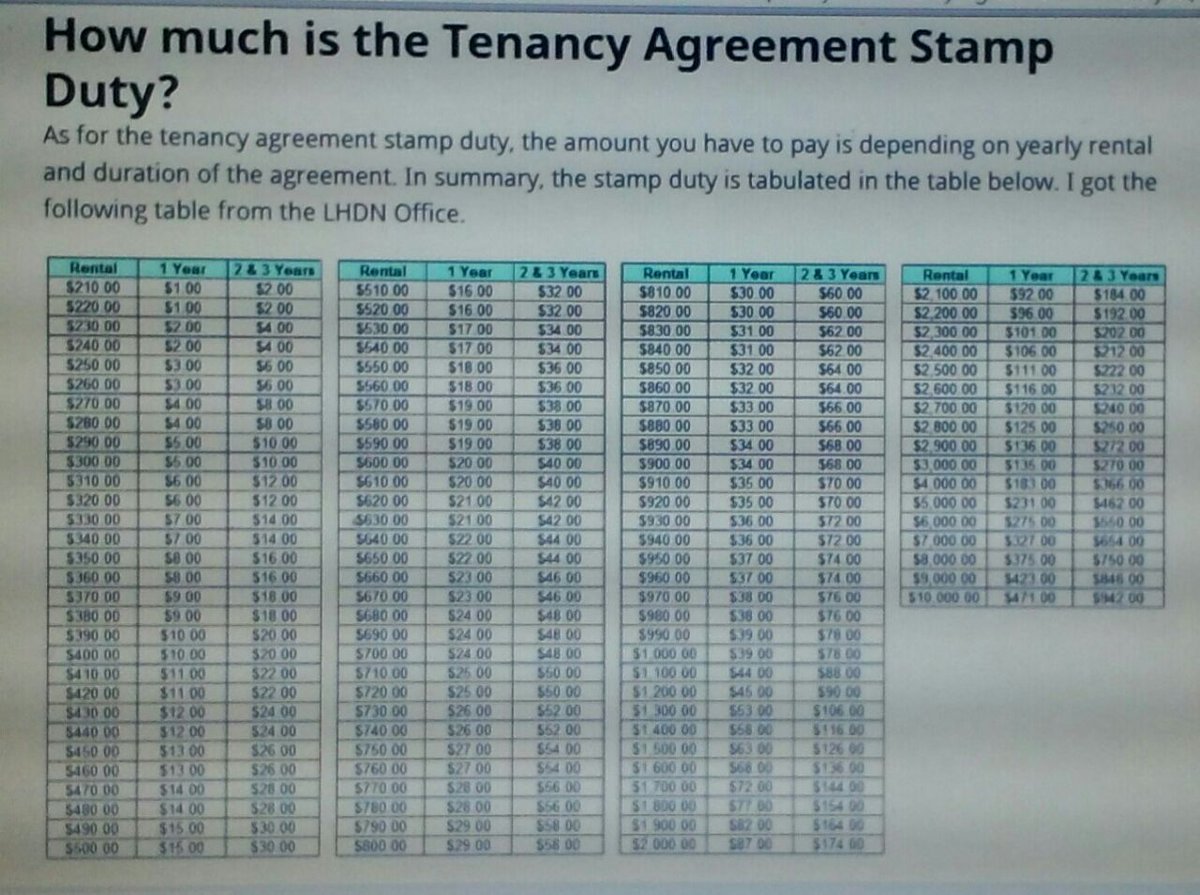

Enter the monthly rental duration number of additional copies to be stamped. In summary the stamp duty is tabulated in the table below. The amount of stamp duty currently payable on the instrument will be shown. Above table listed are for the main copy of tenancy agreement if you have 2nd or 3rd duplicate copy the stamp duty is 10 00 for each copy.

To legitimize a tenancy agreement it is important to note that landlords and tenants must sign it. Stamp duty computation landed properties tenancy agreement. Rm 1000 x 25 rm 250. Rm 12000 annual rent rm 2400 rm 250 x rm 1 1 year rm 38 4 rm39.

I got the following table from the lhdn office. Stamps is an electronic stamp duty assessment and payment system via internet. Instruments liable to stamp duty are those listed in the first schedule of the stamp act 1949 exemptions relief from stamp duty general exemptions under section 35 in first schedule stamp act 1949 and specific exemptions under item 2 4 and 32 in first schedule stamp act 1949. To make things easier let us calculate.

Then the lease must be stamped by lhdn to be legal in court. Basically the stamp duty for tenancy agreements spanning less than one year is rm1 for every rm250 of the annual rent in excess of rm2 400. Online calculator to calculate tenancy agreement stamp duty. Stamp duty a form of tax placed by the government on legal documents must be paid to enter into a lease before rent can be made.

Stamp duty payable 0 4 of the rent for the extended period from 1 jan 2021 31 mar 2021 0 4 x 10 000 x 3 120 for rates before 22 feb 2014 click here. To know the exact stamp duty you need to pay you can visit our free stamping fee calculator.