Islamic Banking System In Malaysia

Islamic banking services in malaysia.

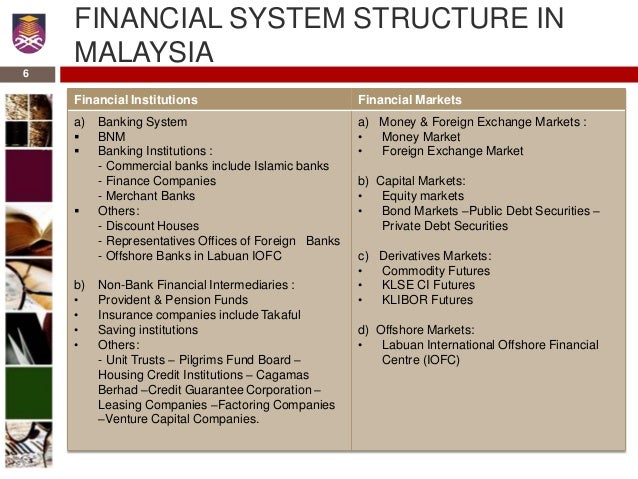

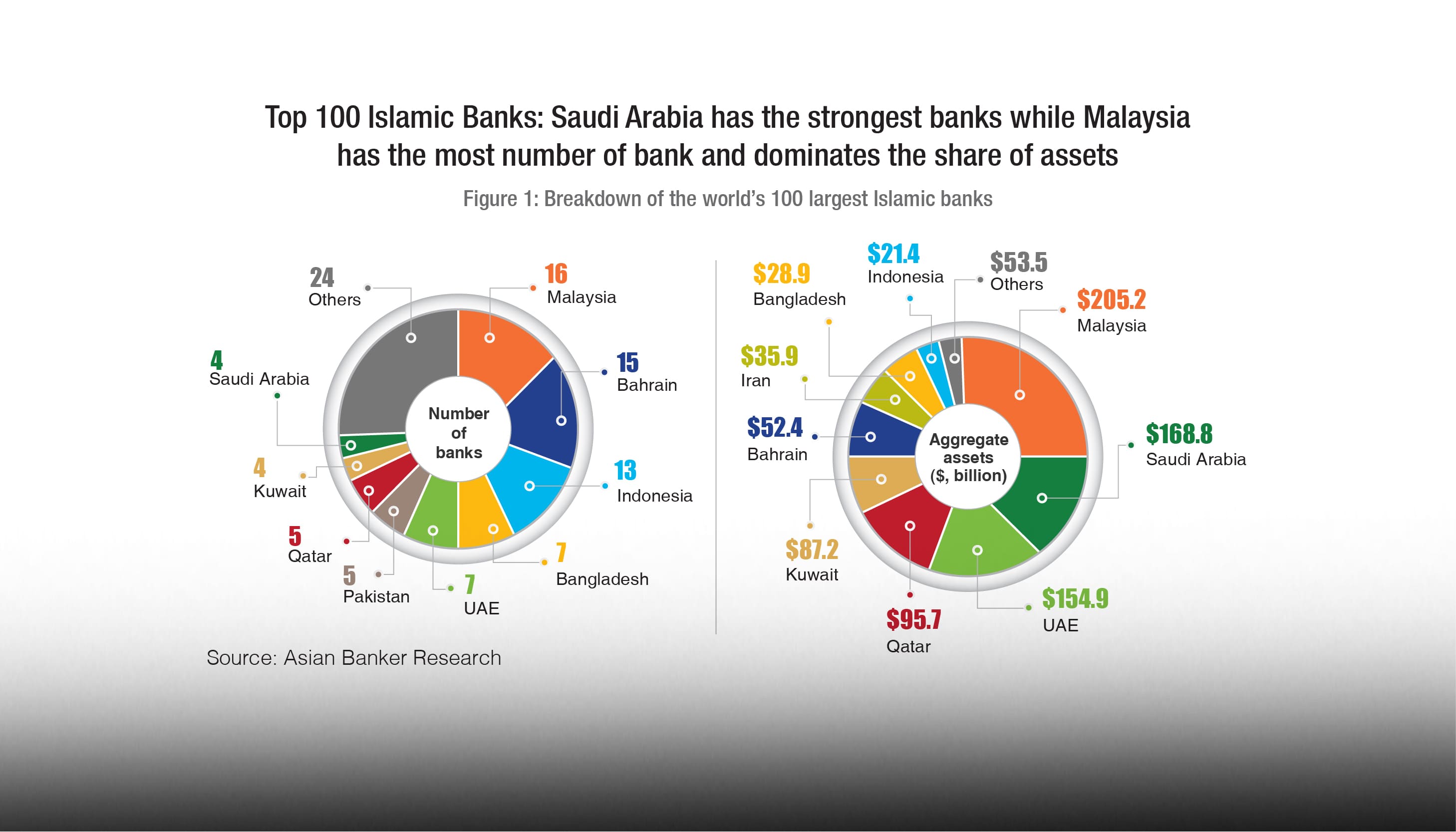

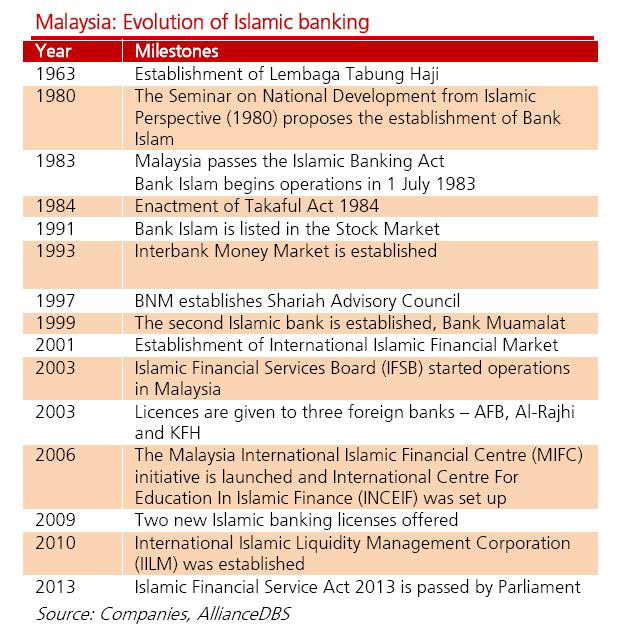

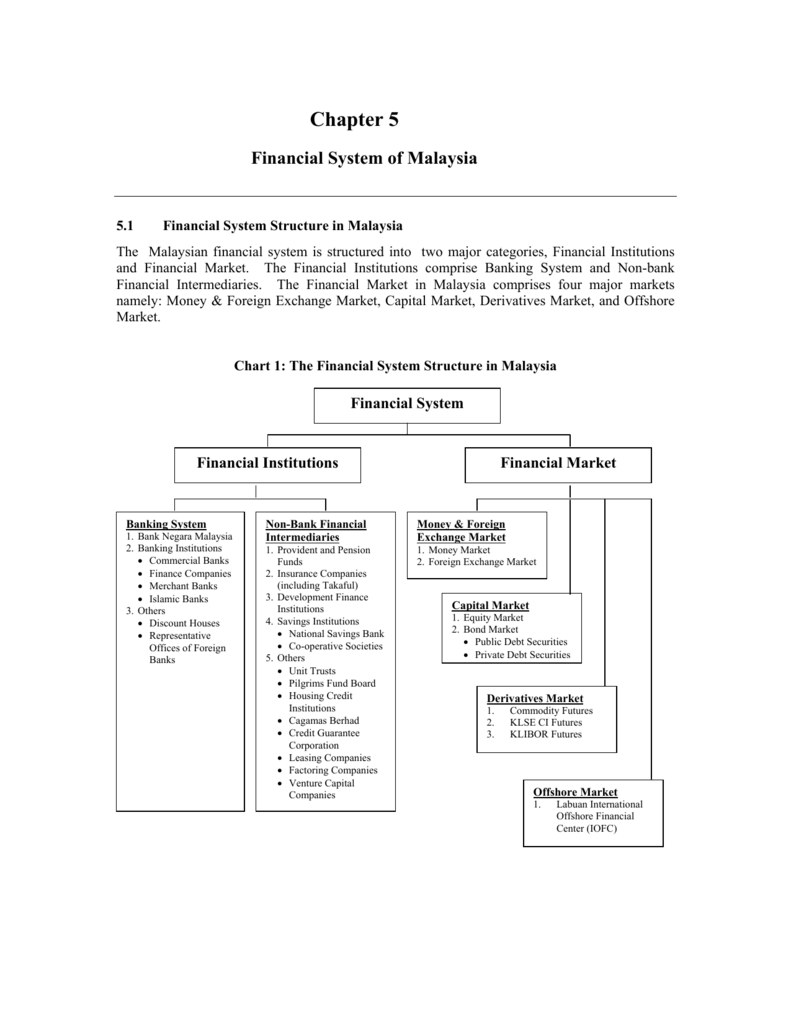

Islamic banking system in malaysia. It fell slightly to 33 3 in 1h2020 according to bank negara s fsr estimate from 33 5 in 2h2019. With the introduction of value based intermediation vbi by bank negara malaysia bnm in 2017 the association of islamic banking and financial institutions malaysia aibim is confident the central bank s target for the local islamic banking industry to have 40 market share in total banking assets by 2020 is achievable. Malaysia also has a comprehensive islamic banking system. According to moody s investors service malaysia remains the biggest islamic finance market in southeast asia.

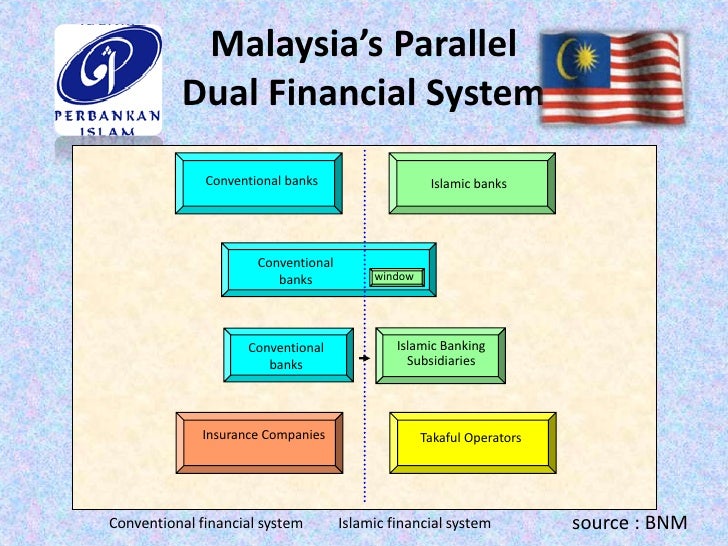

Value based intermediation is the next direction for islamic banking in malaysia. Malaysia s islamic finance industry has been in existence for over 30 years. Presently malaysia has fifteen full fledged islamic banks three of which are from the middle east providing a broad spectrum of financial products and services based on shariah principles. Malaysian islamic banking system is operating side by side with the conventional banking system.

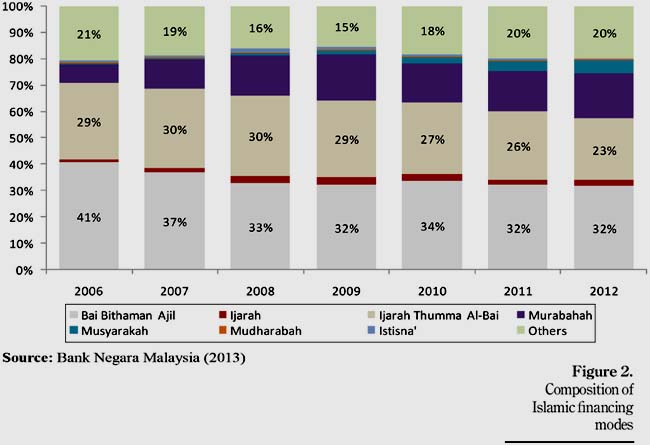

The concept is that islamic banking transactions should not just be shariah compliant but also contribute positively and sustainably to the economy community and environment without compromising the financial returns to shareholders. Salam is an exceptional contract in islamic law which has been legalized to facilitate the people especially the poor famers. 9 3 outpacing that of conventional banking s 3 3 underpinned by the banks. As the islamic banking system developed services offered by islamic banks and banking institutions under islamic banking scheme have become diversified table 1.

It began with the establishment of the malaysian pilgrims fund board tabung haji and the country s first islamic bank bank islam malaysia berhad bimb which began operations on 1 july 1983. In malaysia there are various types of islamic banking products used. Kuala lumpur sept 25. Islamic banking services are very similar to those in conventional banks.

The enactment of the islamic banking act 1983 enabled the country s first islamic bank to be established and thereafter with the liberalisation of the islamic financial system more islamic financial institutions have been established. The islamic financial system in malaysia has witnessed a tremendous growth in demand acceptance and development since its introduction in 1963. Malaysia 100 2019 malaysian islamic banking overview continued momentum amid regulatory push special report healthy financing growth. Nevertheless the islamic finance industry s share of total banking assets including that of dfis is slightly behind.

However some distinct differences can be observed.