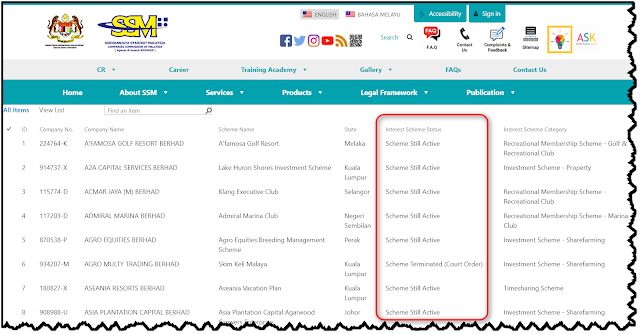

Interest Scheme Act 2016

Interest scheme act 2016 clj created date.

Interest scheme act 2016. On 31 august 2016 the companies bill 2015 together with the interest schemes bill 2015 received royal assent. New companies act 2016 and interest schemes act 2016 gazetted. The interest schemes act 2016 was introduced to regulate the interest schemes the alternative mode of fund raising activities for companies by pooling financial contribution from the public in exchange for an interest in a particular interest scheme. The interest schemes act 2016 which provides stronger investor protection and greater regulatory powers could serve as a catalyst for reviving interest in these schemes which have been negatively perceived by many investors the new law governing interest schemes the interest schemes act 2016 has provisions for stronger investor protection and greater regulatory powers for the companies commission of malaysia ccm also called the registrar.

Previously contained in the companies act 1965 the act was driven by. Neither the new companies act 2016 nor the interest schemes act has been brought into force as at the date of this article. The interest schemes act seeks to regulate the registration administration and dissolution of schemes in malaysia. The interest schemes act 2016 was introduced to regulate the interest schemes the alternative mode of fund raising activities for companies by pooling financial contribution from the public in exchange for an interest in a particular interest scheme.

The interest schemes act 2016 interest schemes act on 15 september 2016. The act came into operation on jan 31 2017 on the same day the new companies act 2016 was effective. Neither the new companies act 2016 nor the interest schemes act has been brought into force as at the date of this article. Application of the act.

The act is also an initiative to introduce a standalone and separate legislation governing the framework of interest schemes previously found in division 5 part iv of the companies act 1965. The act re quires a man age ment com pany to regis ter an in ter est scheme with the ssm prior to any is sue of fer or ad ver tise ment to in vite any per son to par tic i pate in any in ter est scheme fail ing which a con victed of fender may be im pris oned up to 10 years or fined up to rm50 000 000 or both. Key points to note include. Both statutes have been gazetted as the companies act 2016 and the interest schemes act 2016 respectively.

These legislation are not yet in force but are expected to come into. Upon the interest schemes act coming into effect interest schemes would be regulated under a separate legislation. Upon the interest schemes act coming into effect interest schemes would be regulated under a separate legislation.