Inheritance Tax In Malaysia

For context malaysia used to have inheritance tax estate duty.

Inheritance tax in malaysia. Show posts by this member only post 1. Do you think our government should impose inheritance tax. The wealth tax imposes levies on an individual s accumulated assets. What is inheritance tax.

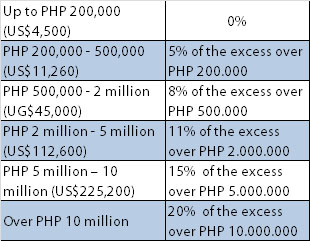

In the present context the inheritance tax rate for malaysia should now be at least 50 percent for estates valued at between rm2 million to rm3 million with a progressive increase as the inheritance amount gets higher. Until then net worth exceeding myr2 million us 543 000 was taxed at five per cent and a rate of 10 percent was imposed on net worth exceeding myr 4 million. Nov 1 2020 02 24 pm updated 2w ago. The much speculated taxes on capital gains and inheritance will not be introduced in budget 2019.

Inheritance tax in malaysia was abolished in 1991. Inheritance tax in malaysia. Sometimes known as death tax it is basically a tax on the estate be it property money or possessions of someone who has died. This includes vacation homes art collections shares bonds and fixed deposit.

Cap has asserted before that the average malaysian shouldn t fear the inheritance tax. There is currently no tax for property inheritance in malaysia. Sources said both capital gains tax cgt and inheritance tax may only be. At the moment malaysia has only witnessed the implementation of tax on income and consumption and not the wealth and inheritance tax.

However this legislation was repealed in 1991. There s currently no tax for estate inheritance in malaysia. Junior member 103 posts joined. An estate of a deceased was liable to a five per cent tax if it was valued above rm2 million and 10 per cent if it was above rm4 million.

A previous version of it was repealed in 1991. Plenty of discussions about the reintroduction of an inheritance tax have been held by successive governments but as of budget 2020 no new laws have been introduced. Prior to the abolition of this tax in 1991 estate duty was applicable only if the net worth of the estate exceeded rm2 million.