Income Tax Rate Malaysia 2018

A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g.

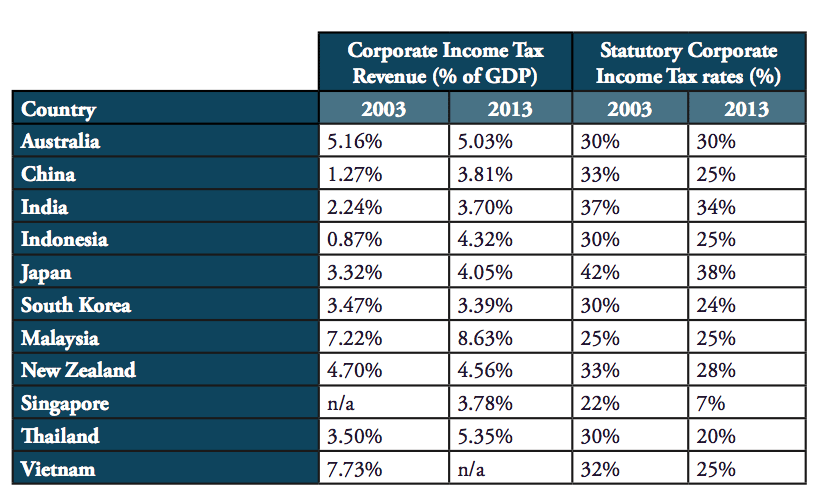

Income tax rate malaysia 2018. There are no other local state or provincial government taxes on income in malaysia. 6 2 taxable income and rates 6 3 inheritance and gift tax 6 4 net wealth tax. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. 2018 2019 malaysian tax booklet 7 scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a.

The standard corporate tax rate of 24 for a period of five years with a possible extension for another five years. Income tax rate malaysia 2018 vs 2017 for assessment year 2018 the irb has made some significant changes in the tax rates for the lower income groups. On the first 2 500. For example let s say your annual taxable income is rm48 000.

Calculations rm rate. Green technology educational services healthcare services creative industries financial advisory and consulting services logistics services tourism. No other taxes are imposed on income from petroleum operations. Not only are the rates 2 lower for those who has a chargeable income between rm20 000 and rm70 000 the maximum tax rate for each income tier is also lower.

Tax booklet income tax. Malaysia personal income tax rate is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a max of 28. These new rates will apply for those who have accumulated their income from january 2018 to december 2018 and are filing their taxes from march april 2019. Malaysia taxation and investment 2018 updated april 2018.

2018 2019 malaysian tax booklet income tax. However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500. Income tax is a type of tax that governments impose on individuals and companies on all. Based on this amount the income tax to pay the government is rm1 640 at a rate of 8.

Tax rm 0 5 000. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia. Rates real property gains tax stamp duty sales tax service tax other duties important filing.