Importance Of Retirement Planning In Malaysia

To do this they will need to have well crafted regularly updated estate planning documents regardless of the size of their assets.

Importance of retirement planning in malaysia. For a safe and comfortable retirement it s important to ask yourself the ultimate question. Miscalculations in terms of your retirement fund can be caused by common misconceptions such as these. Your retirement can contribute to your family too. With all the talk revolving around the epf withdrawal age lately the topic of the best retirement plan in malaysia seems to be on the tip of everybody s tongue.

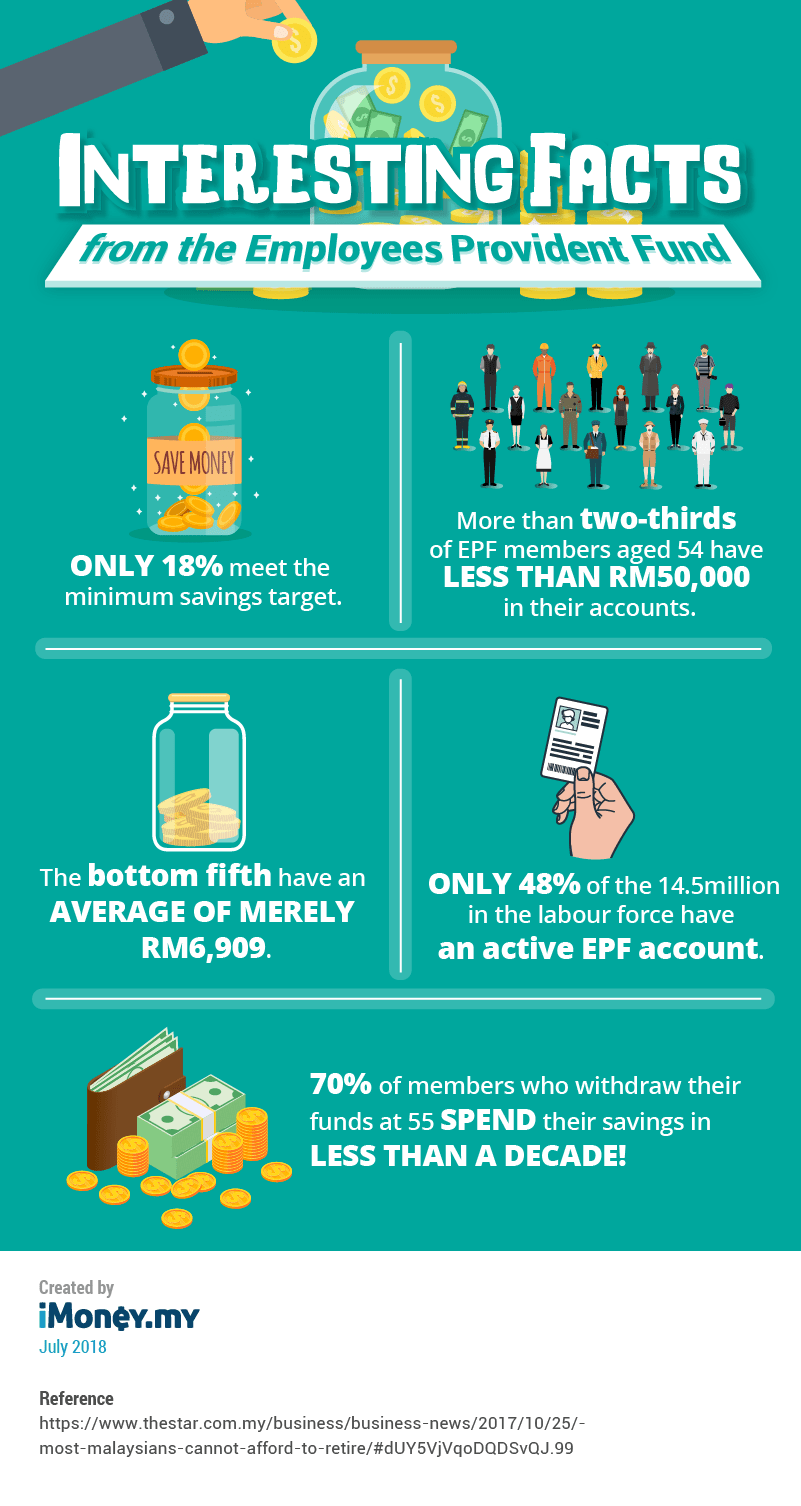

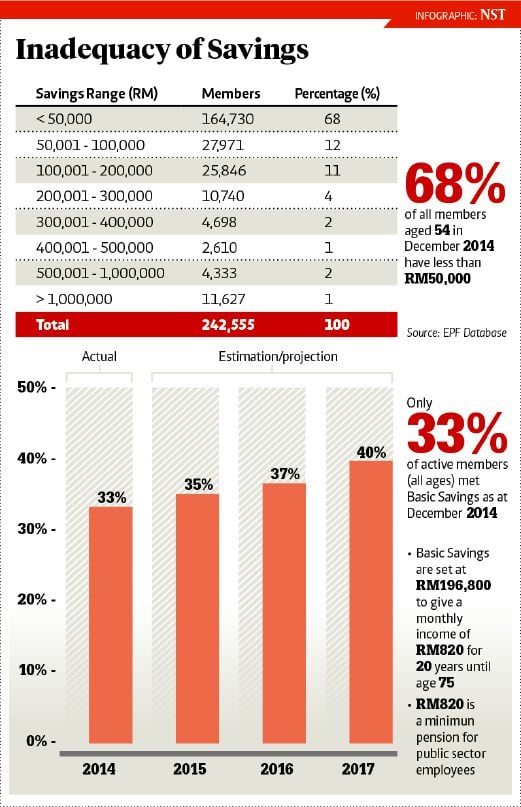

Last year the employees provident fund epf raised the minimum savings target to rm228 000 by the age of 55. Assuming that you plan to retire at 55 simply subtract your current age by 55 and you ll get this number. We take 3 as conservative estimate for computation for living costs in retirement planning. As a part of islamic wealth management islamic retirement planning can be considered as still new in malaysia.

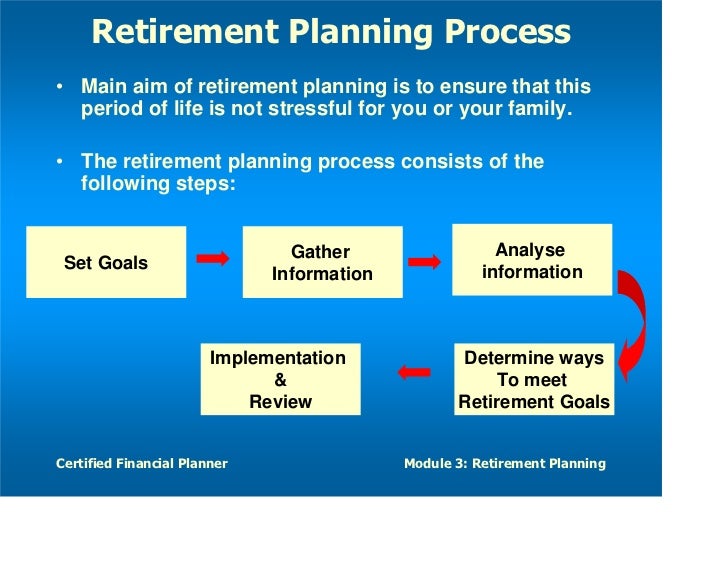

How much is enough and what must i do to get that amount. Currently the retirement plans available in malaysia such as employee provident fund epf. Best retirement plan malaysia. They also need to preserve it so it can be passed on to the next generation.

Manage the inflation risk and outlive your retirement nest egg inflation in malaysia averages between 2 to 3 per year. The importance of retirement planning is a call in malaysia due to fast ageing population in the country. In essence people are worried about retirement. This means a monthly retirement income of the only rm950 per month assuming a life expectancy of 75 years old.

This is measured by the cpi consumer price index indicator from department of statistics of malaysia. In retirement planning it is not enough for malaysians to ensure that they are able to generate wealth. Proper retirement planning is necessary in the event you need to cover any long term care that you may require later in your life. Now you ll need to ascertain the number of years you have before you hit retirement age.

Medicare may not cover every form of care so your retirement savings may become your safety net to pay for in home care or a nursing facility. However with the rising cost of living and a longer lifespan for malaysians coupled with increasing inflation planning for our golden years aka retirement is a more crucial than ever.