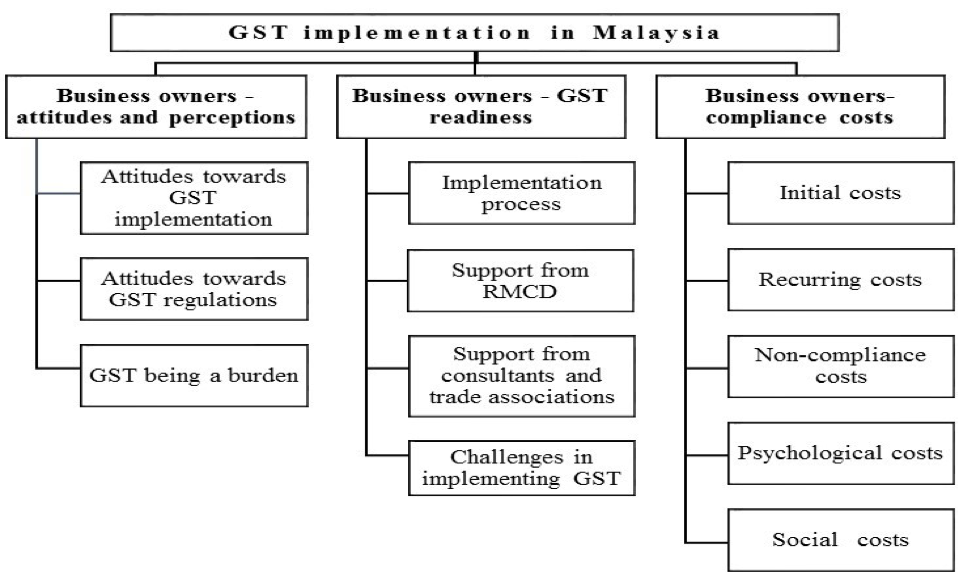

Impact Of Gst On Business In Malaysia

With gst implementation revenue collection increased by about 3 per cent to 219 7 billion malaysian ringgit myr and reduced the fiscal deficit to 3 per cent of gdp in 2017.

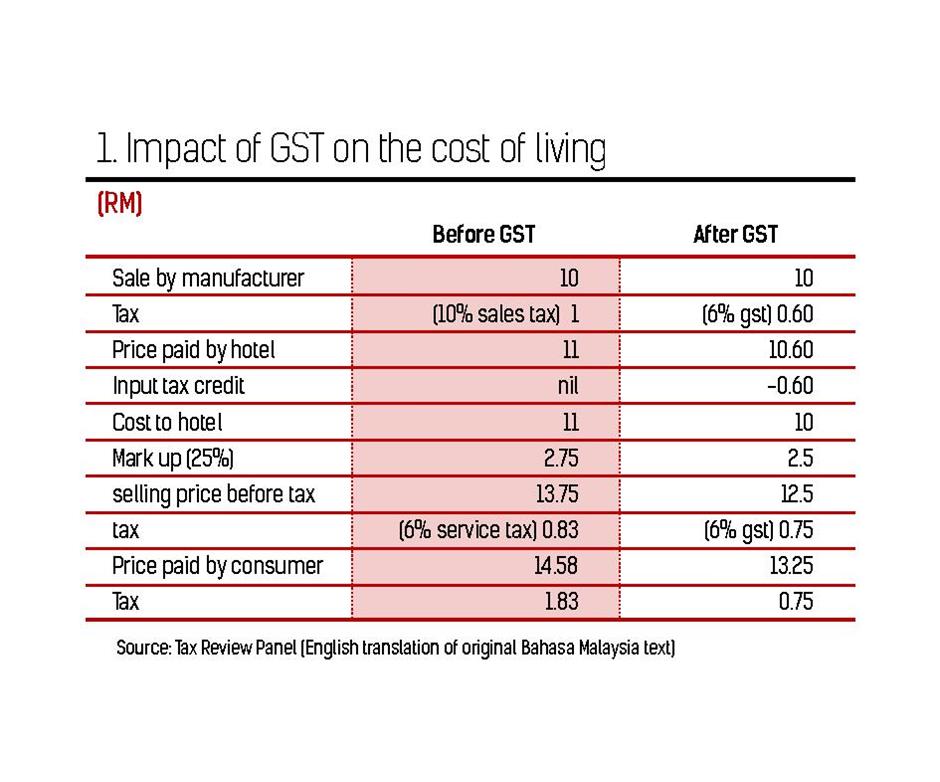

Impact of gst on business in malaysia. It is also expected to affect the lower income consumers purchasing power an increase in. Gst in malaysia has been favorable towards the business people in the country. Public amenities will be exempted. However according to the authorities gst is not a new tax but a replacement tax for malaysia s existing sales tax and service tax sst.

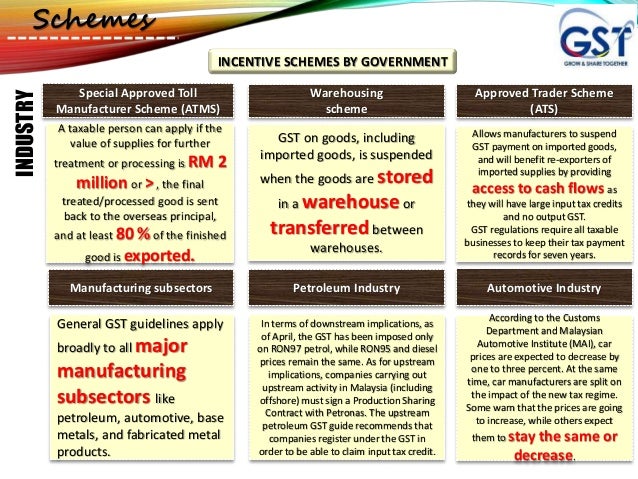

A taxable supply is a supply which is standard rated or zero rated. Weaknesses in the tax regime and the impact of new taxation on the economy to be some. According to the customs department and malaysian automotive institute mai car prices are expected to decrease by one to three percent. So if you are planning on setting up a company in malaysia it s a fairly lucrative time.

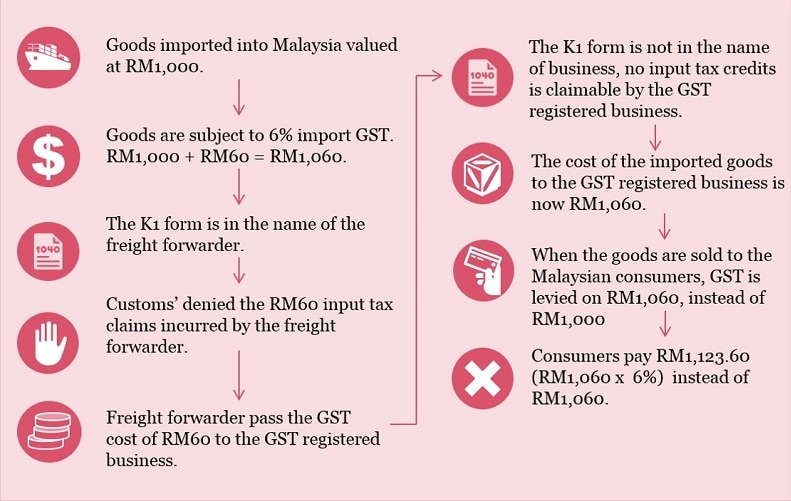

Gst shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in malaysia by a taxable person. Gst among options being. There will be a huge impact on businesses in malaysia when gst is introduced. The effect of the gst on the automotive industry one of malaysia s most important manufacturing sub sectors is unclear.

As the cost of goods reduces consumption rate increases which benefits companies. Our study investigates how the introduction of the gst affected small and medium sized enterprise sme owners in the retail sector. The gst implementation in malaysia is expected to have an impact on the price of the goods and services. Production cost is lower because gst paid on input is claimable by businesses.

There are concerns that the rate of gst could possibly increase in the future to increase revenue for the government. Replacing sales tax and service tax sst in malaysia one of the common misconceptions about the gst is that it is a new tax that will make you pay more for everything you buy. Basic and essential foodstuff will be zero rated. From 1st of april 2015.

Based on the malaysian gst model the price effects are minimal due to. Because gst is a form of broad based tax it will impact the majority of malaysians who are not taxpayers right now.