Impact Of Gst In Malaysia

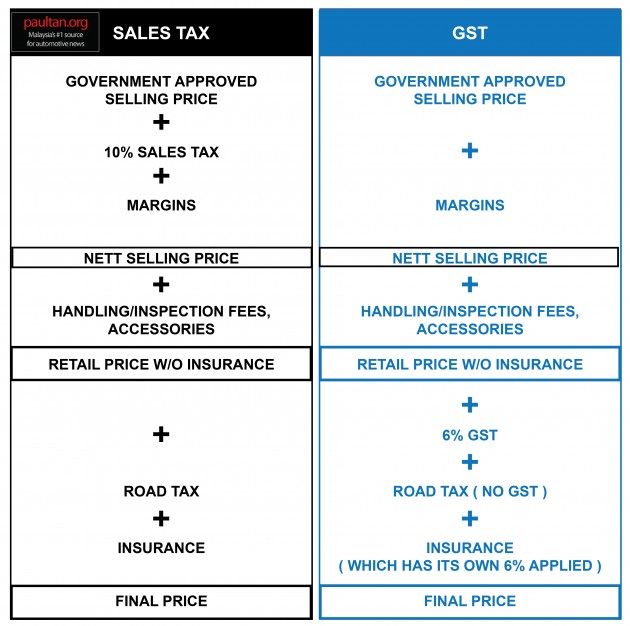

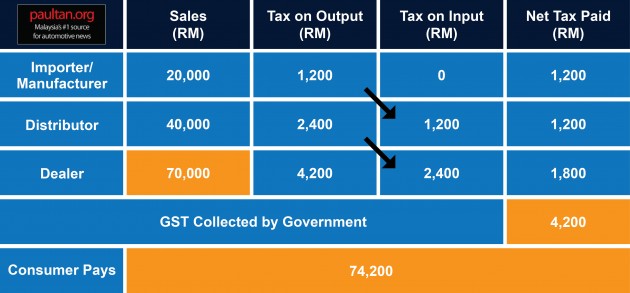

However according to the authorities gst is not a new tax but a replacement tax for malaysia s existing sales tax and service tax sst.

Impact of gst in malaysia. Based on the malaysian gst model the price effects are minimal due to. Malaysia will impose a tax of between 5 per cent and 10 per cent on the sale of goods while services will attract a 6 per cent levy when a new tax regime comes into effect on. Gst impact last updated. For more information regarding the change and guide please refer to.

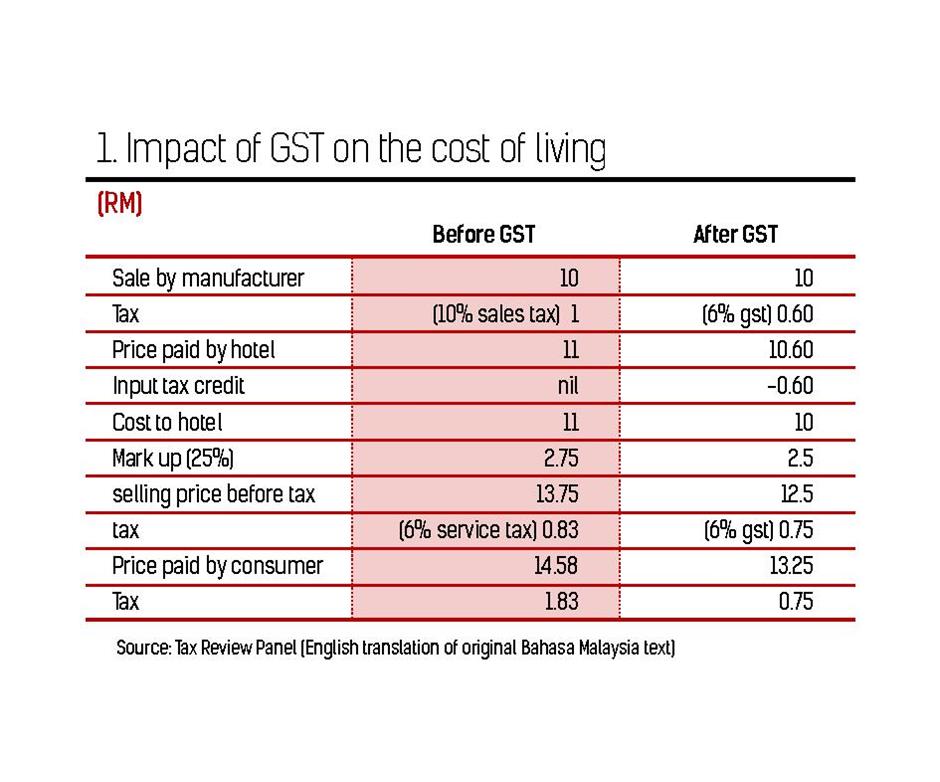

In malaysia one of the common misconceptions about the gst is that it is a new tax that will make you pay more for everything you buy. Gst being implemented by government since 1 st april 2015 and it caused. The cascading effect means a tax on tax. Implementation of gst brings out negative impact to malaysia.

Gst is a combination of all the indirect taxes which was levied on the common public so it serves as bucket which contains all the indirect taxes in it. A major concern about the implementation of the gst is the resulting price effects on consumers. Gst can help the diversification of income sources for the government instead of just relying on income tax and petroleum tax alone. 26 8 2013 16 17 impact on consumer price effects on consumers.

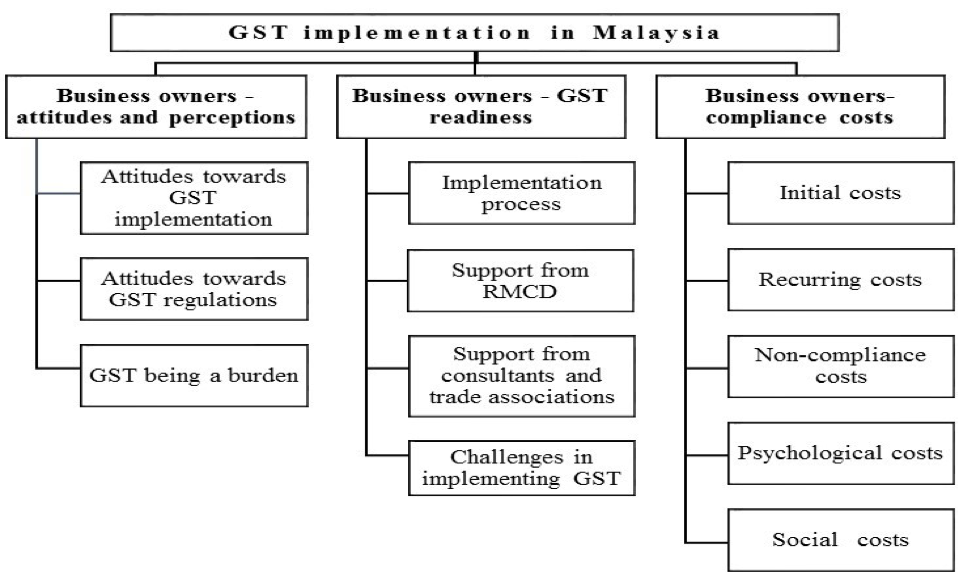

This study examines the impact of the gst on the malaysian economy from three major perspectives. The gst implementation in malaysia is expected to have an impact on the price of the goods and services. It is also expected to affect the lower income consumers purchasing power an increase in. Goods and services tax gst in malaysia the ministry of finance mof announced that starting from 1 june 2018 the rate of the goods and service tax gst will be reduced to 0 from the current 6.

Basic and essential. First it investigates the consequent changes in sectoral responses including output and prices. Malaysia gst reduced to zero.