Hong Leong Bank Moratorium Car Loan

Get up to date announcements and information from us on hong leong islamic bank s covid 19 financial relief schemes moratorium.

Hong leong bank moratorium car loan. From april 2021 to december 2021 you either pay 50 of your existing instalment or your interest only whichever is higher. In january 2022 you resume your existing instalments. Our covid 19 safeguard measures implemented at our branches to help protect the well being of our customers and employees. March 25 2020 18 06 pm 08.

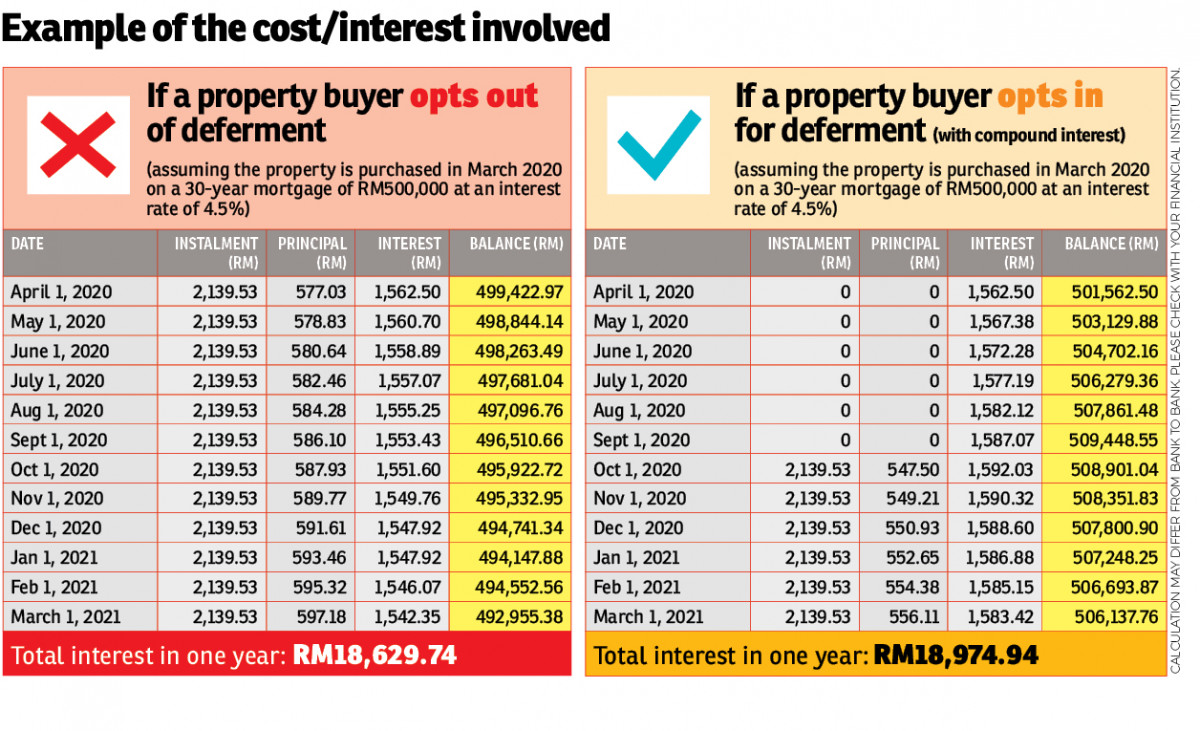

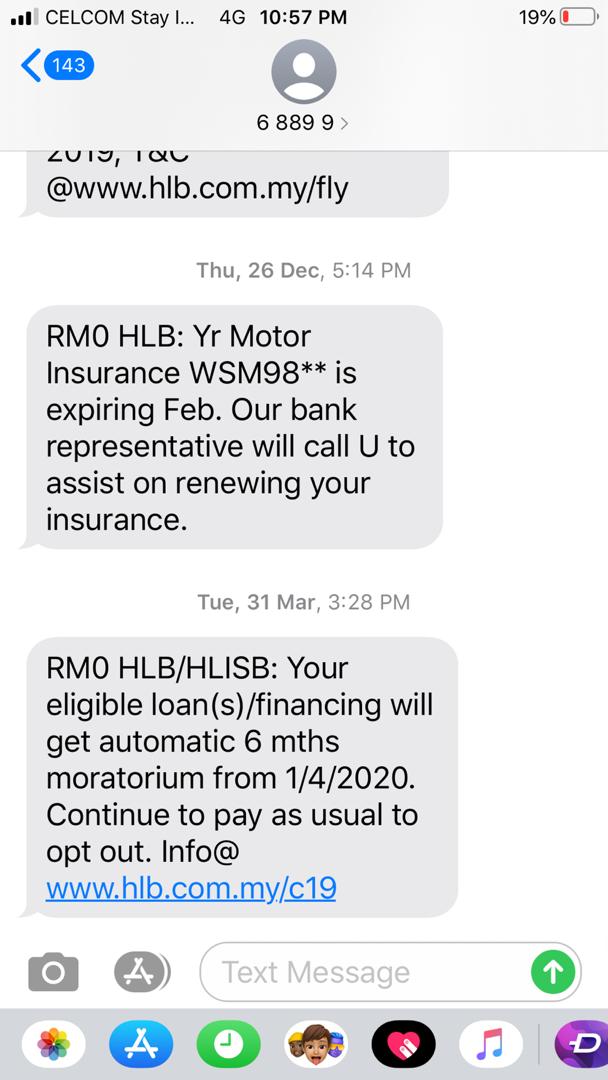

Hong leong finance does not detail their fees for their car loan products. Payments can be made online via hong leong connect interbank giro meps ibg standing instruction facility casa auto debit atms cdms or at any of our hong leong bank branches. Hong leong bank bhd and hong leong islamic bank bhd have offered their customers the option of converting their credit. Existing loan financing deferment program for individuals and smes launched on 1st april 2020 on 1 st april 2020 hlb and hlisb introduced the hlb hlisb loan financing deferment program for eligible individuals and business sme customers whereby auto deferment of your monthly instalment payment obligations are offered for 6 months commencing 1 st april 2020 to 30 th september 2020.

To combat the covid 19 outbreak hong leong finance has rolled out covid 19 loan relief schemes to help customers to tide over difficult time. For a period of 6 months from october 2020 to march 2021 you only need to pay 25 of your exiting loan instalment 75 reduction. Up to 7 years tenure enjoy flexibility in repayment periods. Hong leong bank offers six month moratorium on loan repayments provides measures for cardholders as well.

Kuala lumpur march 25. Personal loan sign up today and enjoy interest rates as low as 3 88 p a. Contact us or visit our branch at 7 wallich street b1 25 and b1 26 guoco tower singapore 078884. At hl bank.

Up to 70 financing ease your mind with affordable instalments. It is important to fully understand fees and other terms and conditions before applying from a loan from any bank as fees can significantly impact your total cost of borrowing. However other banks charge fees for late payments and repaying your loan in full before the end of the loan tenure. While we have seen early positive signs in controlling the spread of covid 19 in malaysia through the movement control order mco uncertainty is still in the air and this will have an impact on our socio economic activities for some time to come.

Hong leong bank bhd s hong leong bank cash forgone due to the loan moratorium will be immaterial analysts opine as the bank s liquidity is at approximately 85 per cent with. Looking to purchase a new car. What happens if i settled the loan earlier than the date originally agreed upon.