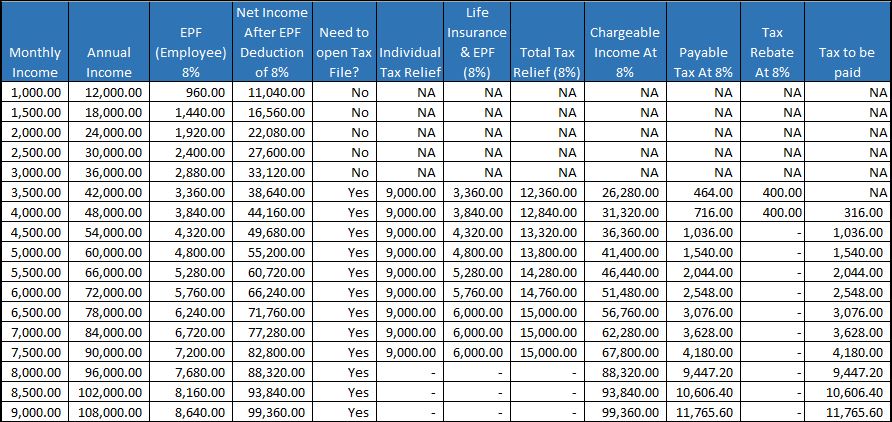

Epf Contribution Rate Table

Ref contribution rate section e rm5 000 and below.

Epf contribution rate table. Employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12. For employees who receive wages salary of rm5 000 and below the portion of employee s contribution is 11 of their monthly salary while the employer contributes 13. The minimum employee contribution rate for the employees provident fund epf will be set at 9 starting from january 2021 for a period of 12 months. Employers are required to remit epf contributions based on this schedule.

The epf receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non pensionable public sectors as well as voluntary contributions by those in the informal sector. For employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12. For members aged 60 years and above the employees share of contribution rate will remain at 0. The latest contribution rate for employees and employers effective january 2019 salary wage can be referred in the third schedule epf act 1991 click to download.

Minimum employers share of epf statutory. 22 09 1997 onwards 10 enhanced rate 12 a establishment paying contribution 8 33 to 10 b establishment paying contribution 10 to 12. Provident fund contribution 10 w e f. Employees pension scheme 1995 replacing the employees family pension scheme 1971 eps table below gives the rates of contribution of epf eps edli admin charges in india.

The 7 contribution rate will take effect from 1st april 2020 until the end of 2020 and it will be applicable to all epf members under 60 years of age that are subject to statutory contribution. For employees who receive wages salary of rm5 000 and below the portion of employee s contribution is 11 of their monthly salary. The announcement was made by finance minister tengku zafrul aziz today during the tabling of budget 2021. 12 ref contribution rate section a.

The existing contribution rate was 12 in some cases 10 as maybe notified by government which has been reduced to 10 by the government. Employees provident fund scheme eps 1952. Employees deposit linked insurance scheme edils 1976.