Difference Between Gst And Sst

As mentioned earlier the gst was introduced in april 1 st 2015 with the goal to implement tax on various consumable services and bring wide range of products under value added services.

Difference between gst and sst. Difference between sst and gst. We are going to outline these differences to help you learn more about these two types of taxation systems. Before the sst is officially implemented take time to enjoy the honeymoon period of spending money in malaysia. Because sst is deducted based on the sales made.

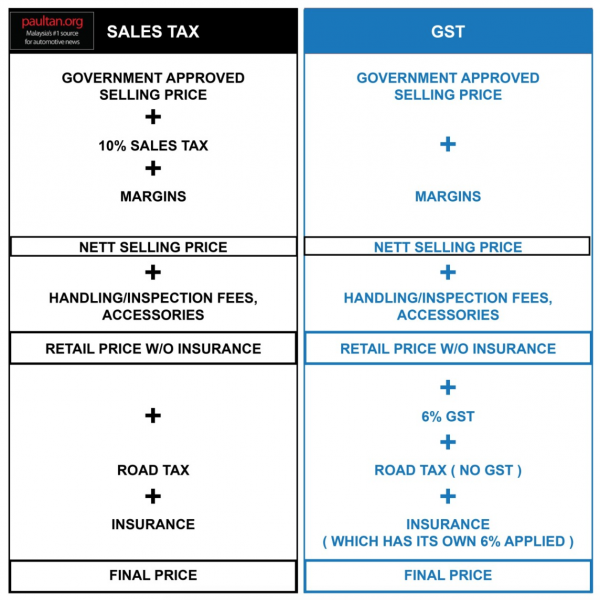

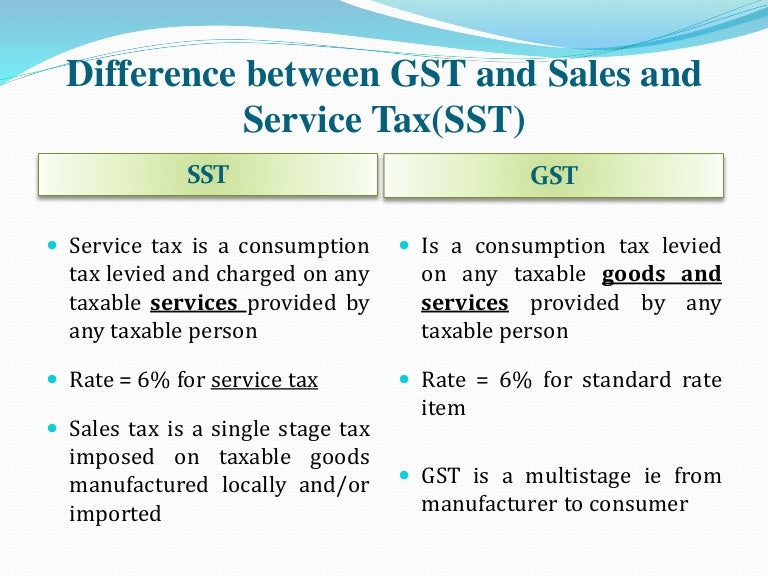

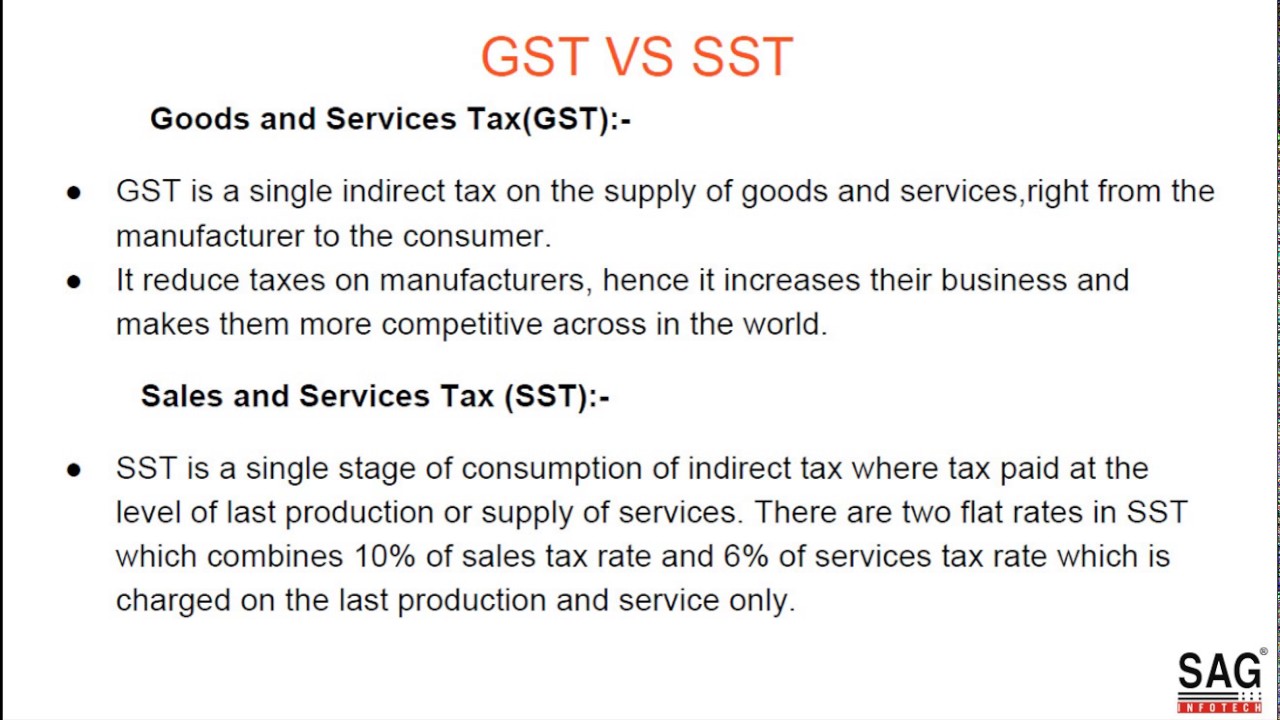

The sales and services tax sst was recently reintroduced back in malaysia as part of pakatan harapan s post election victory manifesto during ge 18. The sales tax in malaysia was a federal consumption tax that was introduced and implemented on a wide variety of goods and governed by the sales tax act 1972. Gst levies a single standard tax rate for all supply of goods and services india. To put it simply the sst consists of two separate taxes that are governed by two distinct tax laws on goods and services at a single stage.

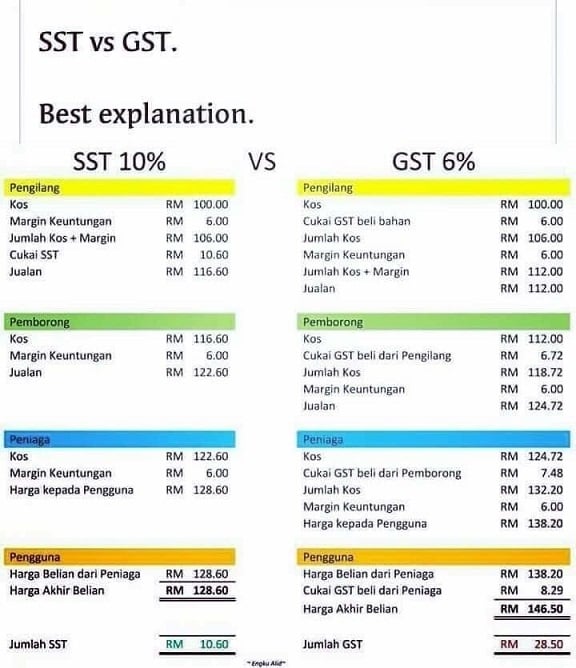

The service tax was governed by the service tax act 1975 and this was also a federal consumption tax. Sst is a service tax levied on any taxable service carried out by a taxable individual and a sales tax levied either at the manufacturer level or consumer level once only. Difference between gst and sst sales service tax updated on may 18 2018 posted by ca hitesh sukhnani posted in gst articles service tax taxes in india biggest indirect tax regime of india the goods and services tax gst is on its way to be adapted worldwide. Gst is business friendly as the input tax credit is available but sst is a cost to the business.

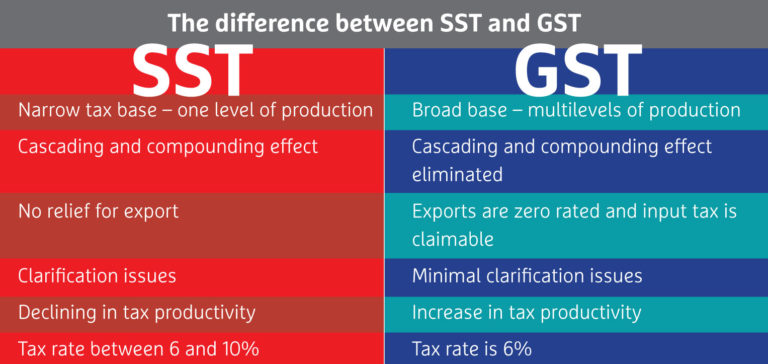

Malaysia s gst vs sst knowing the difference. Under the gst regime input tax is available as a credit or deduction against output tax based on tax invoice received from gst registrant suppliers. So depending on the sst coverage consumers could be paying the same or slightly more for certain items. The difference between gst and sst is that gst is a unified and indirect tax that is levied on the supply of goods and services.

There are a few differences between sst and gst which you need to know about. Prices of goods and services are inclusive of gst but sst is not included in selling price because it operates as add on selling price. Difference between gst and sst in malaysia before you read about the differentiations between these two policies first you should know why gst got finally obsolete in malaysia. The above two differences are about the basic differences between gst and sst which is also the fundamental reason why people of our country opposed the implementation of gst in the first place.

Main differences between gst and sst. The differences between sst gst.