Difference Between Gst And Sst In Malaysia

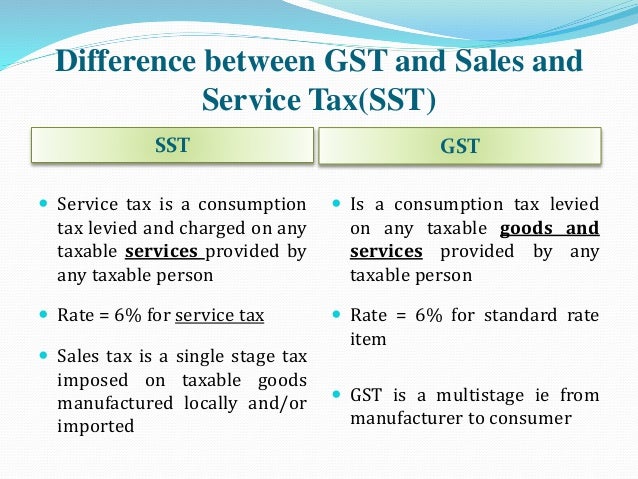

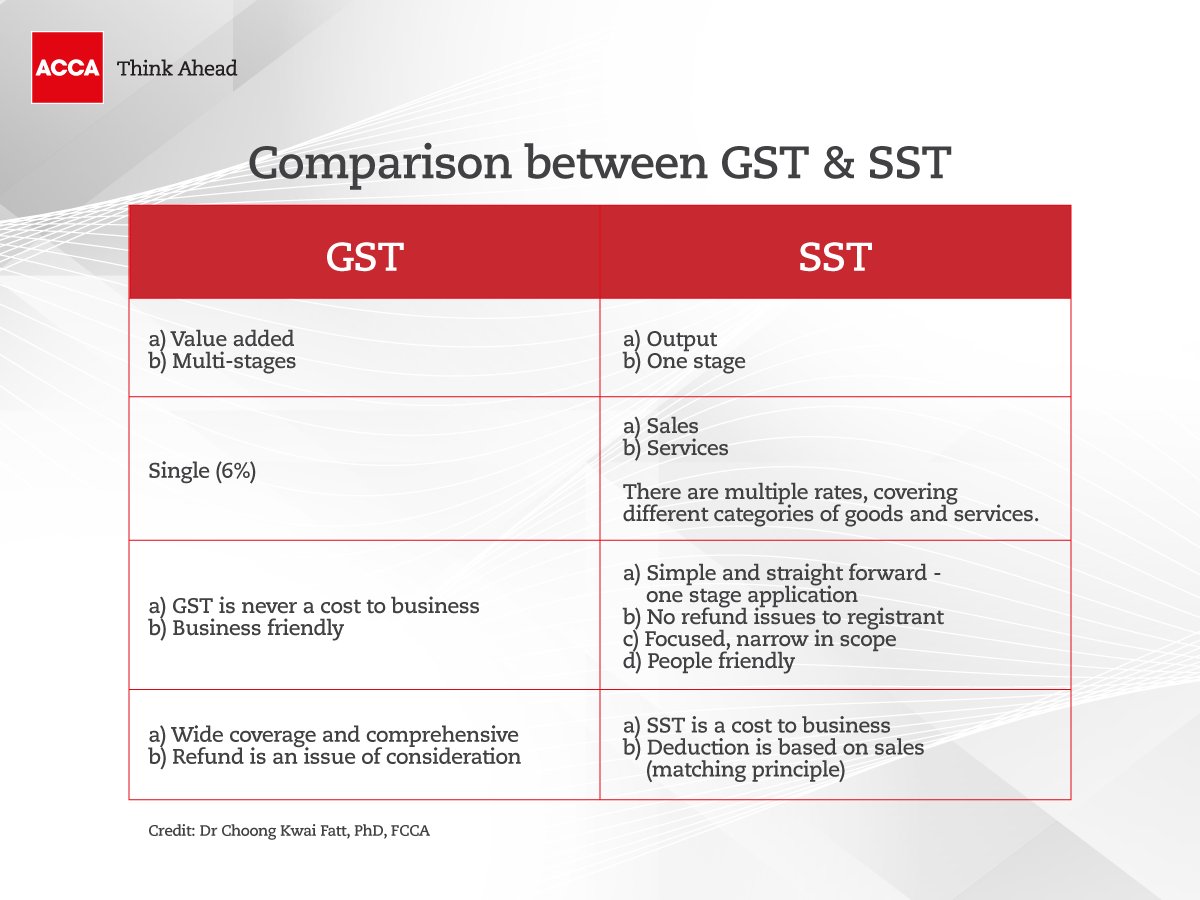

Sales and services tax sst the sales tax is only imposed on the manufacturer level the service tax is imposed on consumers that are using tax services.

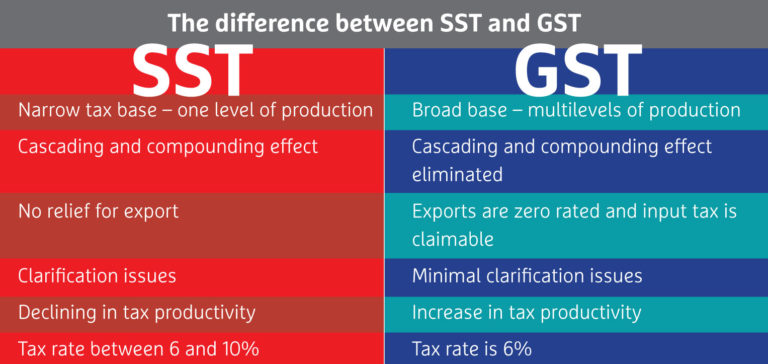

Difference between gst and sst in malaysia. This includes administrative matters which concern registration and invoicing requirements to the penalty and interest rates and the overhaul from this will undoubtedly impose a substantial transformation to malaysia s commercial operations. 5 10 for taxable service. Gst is significantly different from the previous regime in terms of procedural differences. While both gst and sst require registration for a turnover of more than 500 000 sst does not include any buying or selling of a home or property while gst is included.

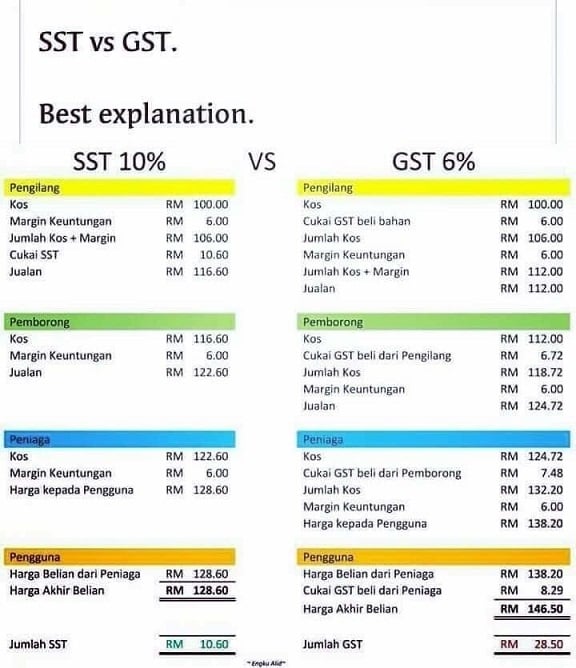

Sst rates are less transparent than the gst which had a standard 6 rate the sst rates vary from 6 or 10. Sales and service tax sst goods and service tax gst tax rate. For an average person buying a house is hard enough plus a 6 per cent excise tax makes it harder to buy a house. Goods and services tax gst gst covers everyone retailers and trades.

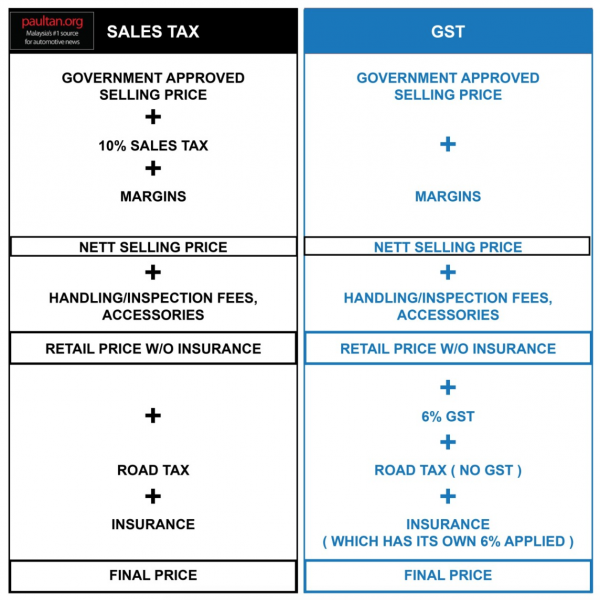

Let us now see the difference between obsolete gst and sst in malaysia. For all goods and services that falls under taxable criteria.