Compare Between Gst And Sst

This includes administrative matters which concern registration and invoicing requirements to the penalty and interest rates and the overhaul from this will undoubtedly impose a substantial transformation to malaysia s commercial operations.

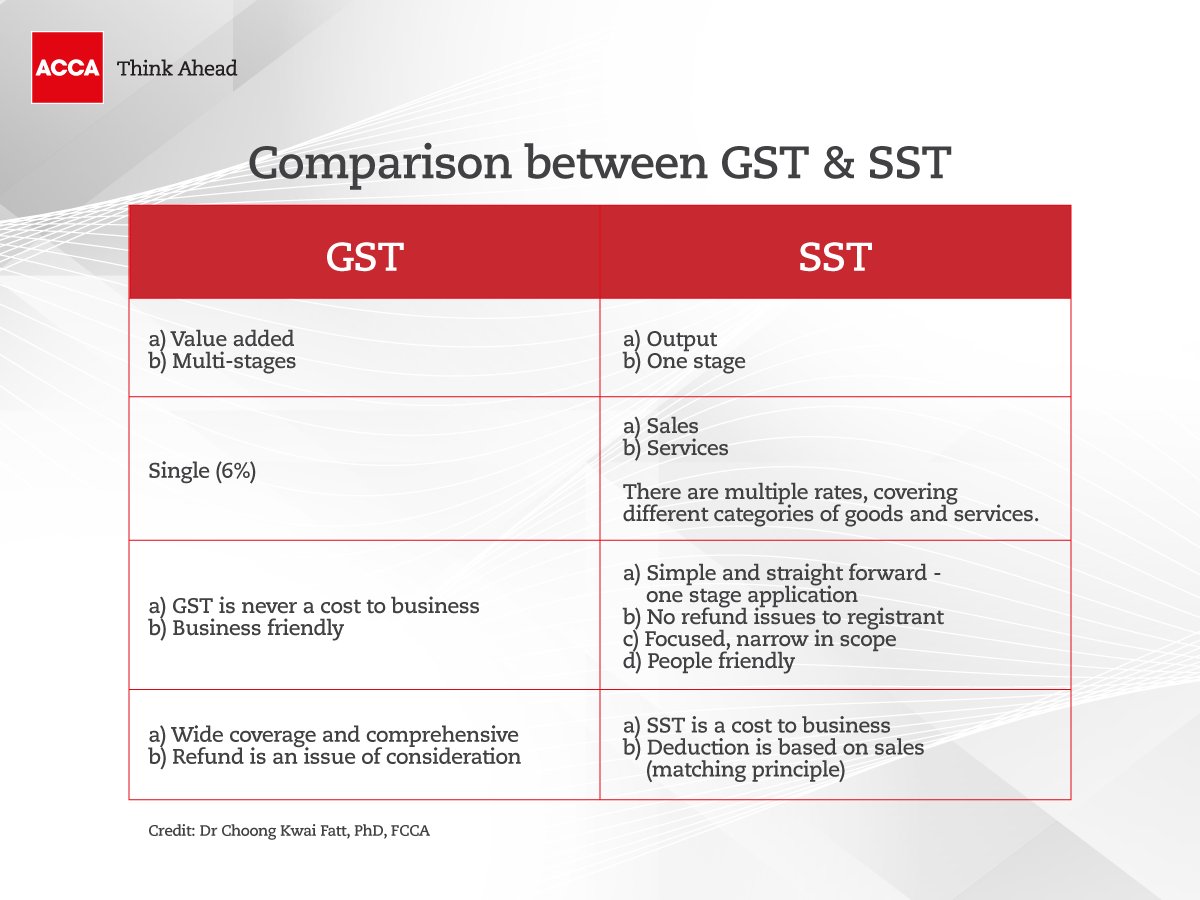

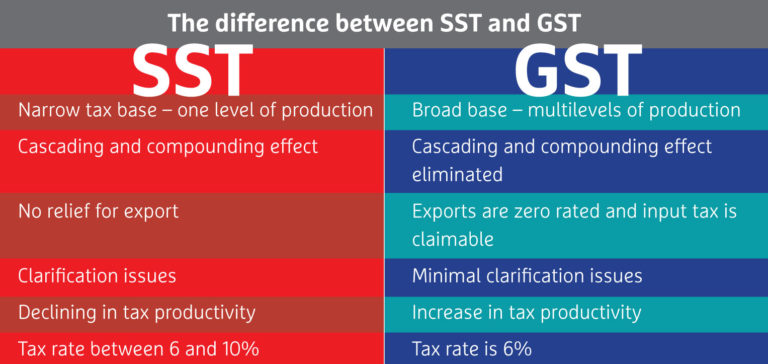

Compare between gst and sst. The sst rates are less transparent than the standard 6 gst the sst rates vary between 6 and 10. Gst is the some of many tax laws like vat service tax excise act purchase tax entry tax additional customs duty etc where service tax is just a part of gst. Goods and services tax gst gst covers everyone retailers and trades. The battle between gst vs sst is real.

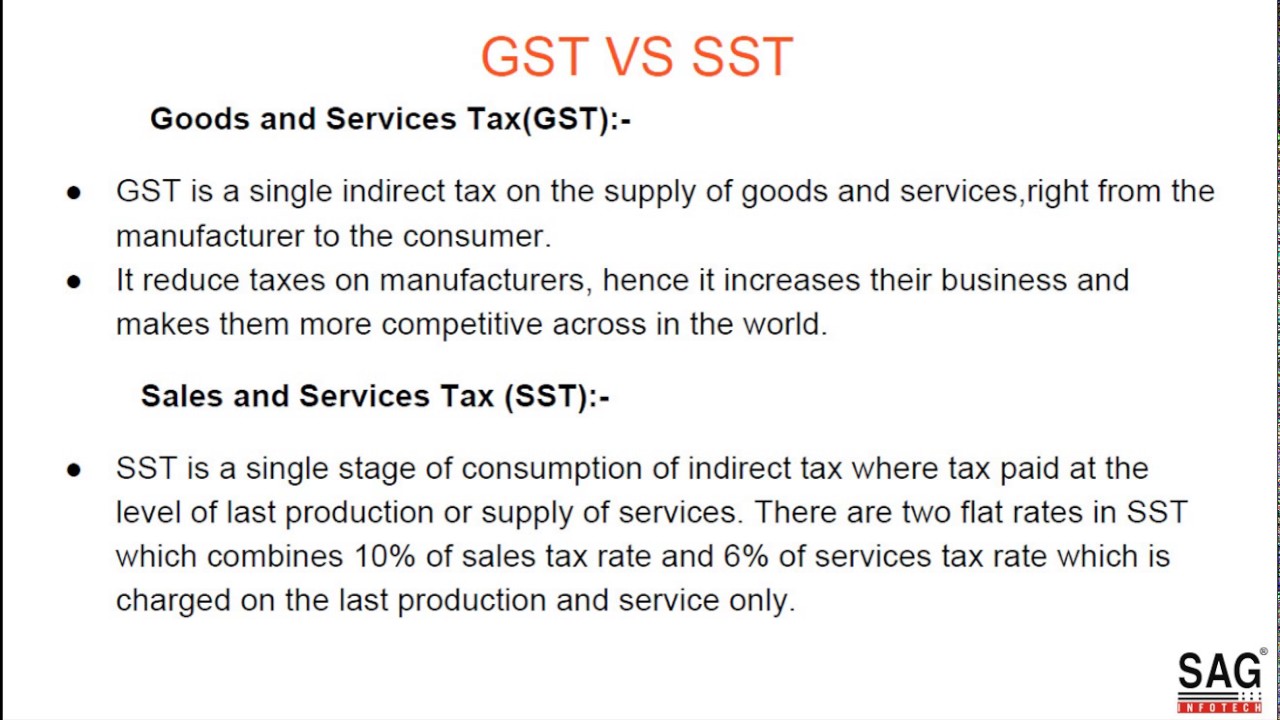

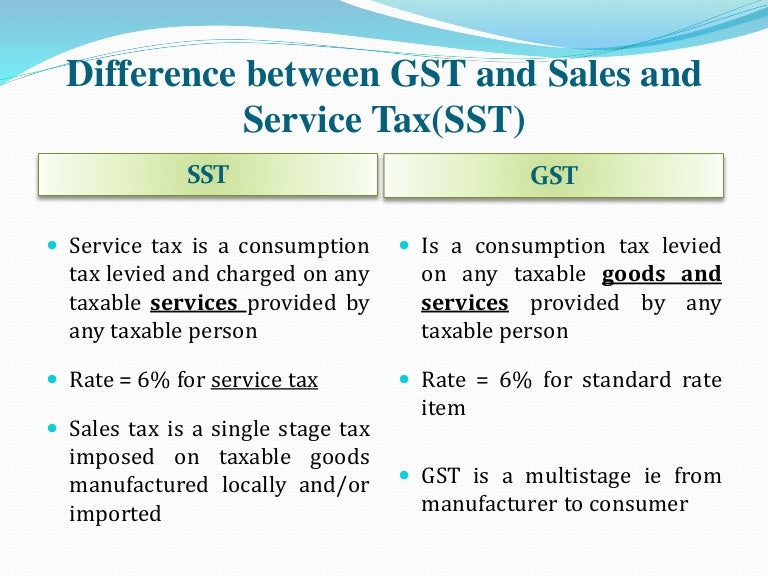

Exempted supplies zero rated gst relief of gst. Sst is a service tax levied on any taxable service carried out by a taxable individual and a sales tax levied either at the manufacturer level or consumer level once only. Here are some major differences between the gst and the sst that you should know as a business owner. As mentioned earlier the gst was introduced in april 1 st 2015 with the goal to implement tax on various consumable services and bring wide range of products under value added services.

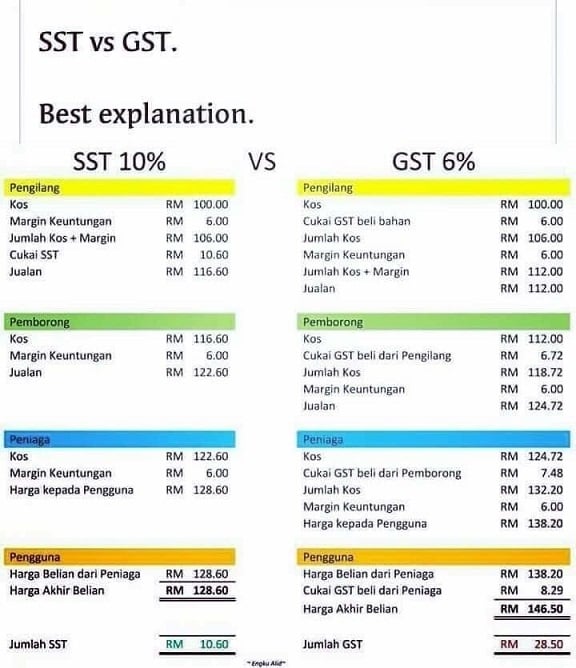

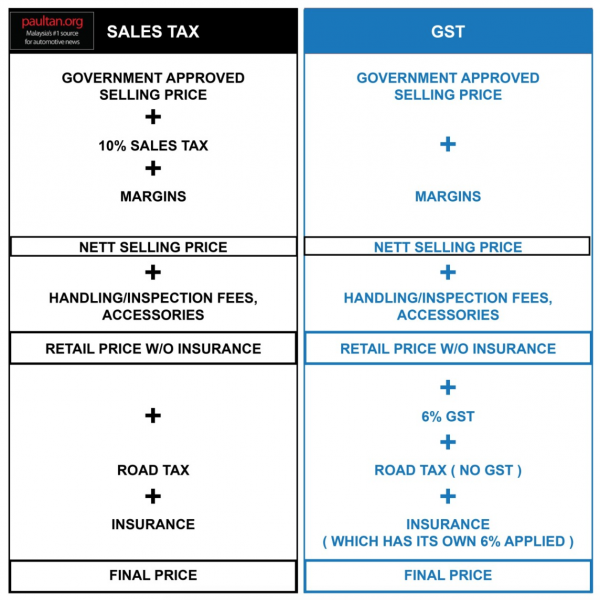

Sst only goods services that fall under the sst list are to be taxed. The supply chain moving from manufacturers to distributors dealers and to consumers would result in higher pricing as gst is imposed on final stage comprising of value add and profit margin. Sst rates are less transparent than the gst which had a standard 6 rate the sst rates vary from 6 or 10. The rate of gst will be define by the gst committee.

What is the difference between gst and sst. Gst is a multi stage 6 goods and services tax that is charged and collected at every stage of the supply chain. Sst refers to sales and service tax. Gst is significantly different from the previous regime in terms of procedural differences.

Difference between service tax and gst. Up to this day when this post is made people are still arguing and debating about it. Gst stands for goods and services tax while sst stands for sales and service tax. The sales tax only covers manufacturers while services tax covers certain prescribed services like professional services.

Most possible rate should be between 18 20. Gst is operating on a value added concept with input tax available as deduction. Gst all goods and services are subject to gst except. Sst is a business cost.

The sales tax is only levied on the level of the producer or manufacturer while the service tax is imposed on all customers who use tax services.