Car Loan Settlement Process Malaysia

To ensure you qualify for a car loan you have to be sure that you provide all the necessary documents for your application.

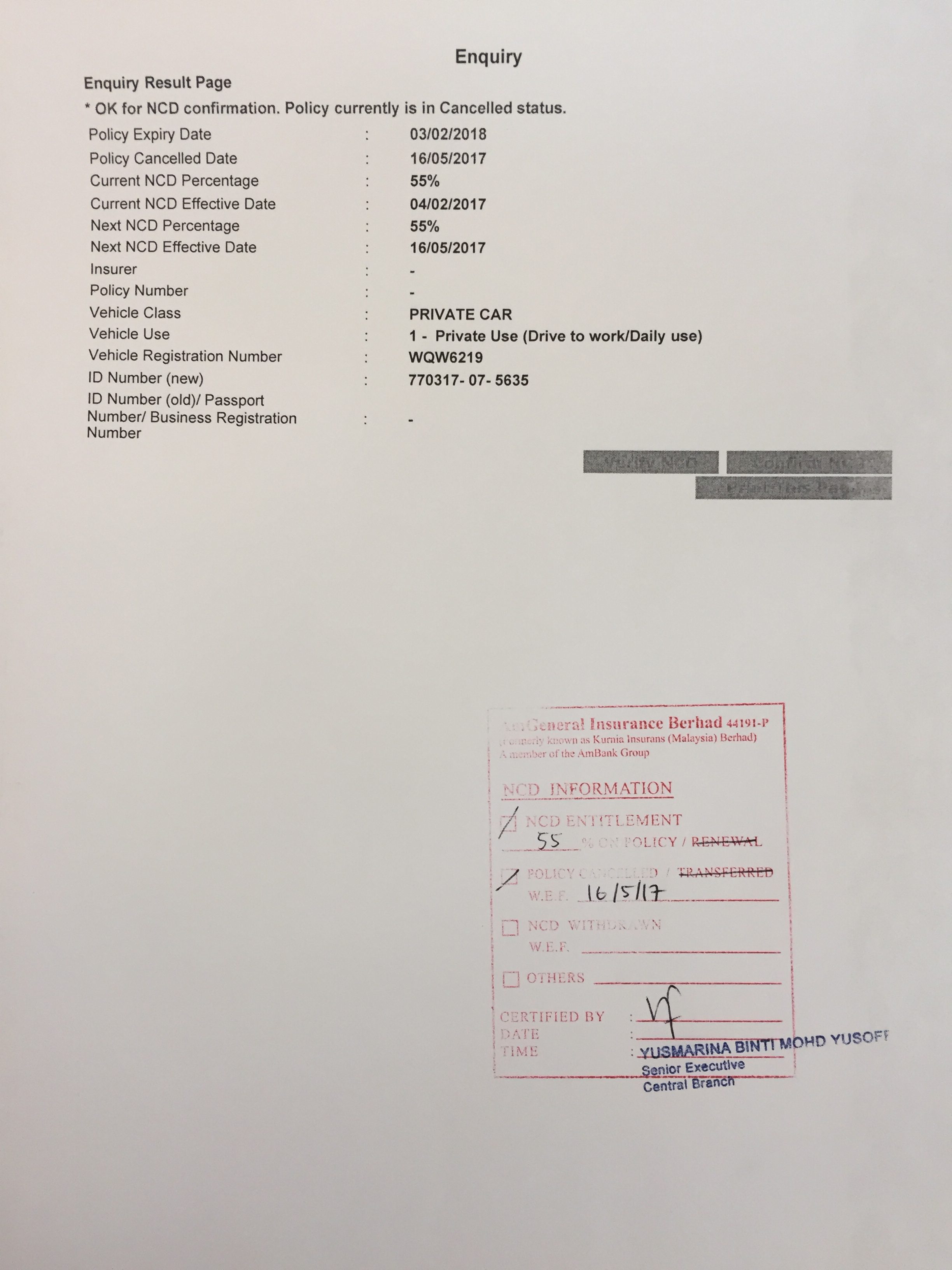

Car loan settlement process malaysia. Use our car loan calculator to find finance that matches your budget. Early redemption amount for car loans in singapore is calculated based on the rule of 78 which is a method of allocating the interest charge on a loan across its payment periods. Settlement release letter. After you complete the installation of the car loan you will be contacted by the bank to collect the settlement release letter to show that you have completed all your payments also to collect the vehicle registration card if you have never collect before.

Find out the settlement amount here. We ve got flexi loans graduate loans low interest rate loans and the best used car loans on the market. Best car loans in malaysia whether you re buying a new or used car you ll find our comprehensive malaysian auto loan list steers you in the right direction. Public bank a complete one stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers.

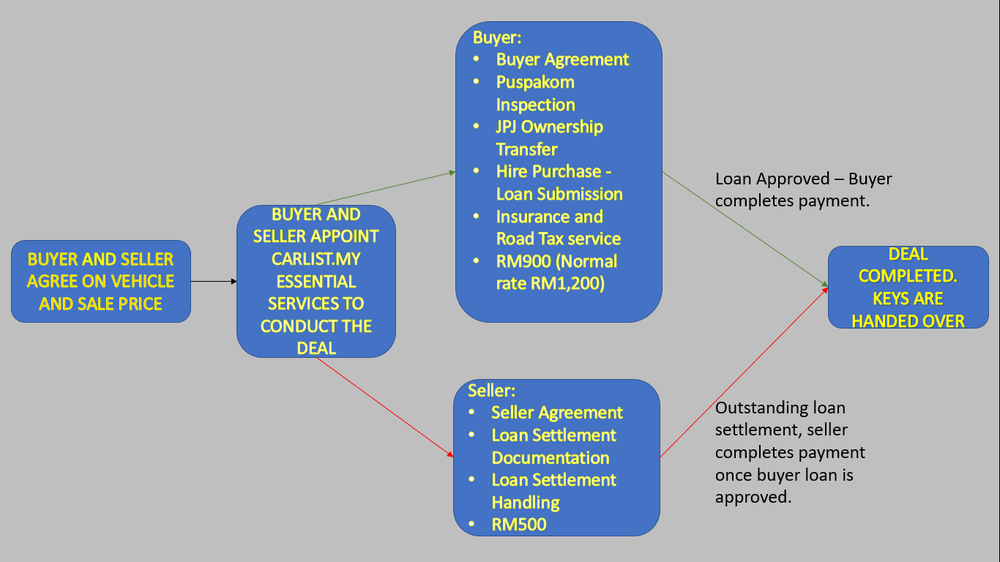

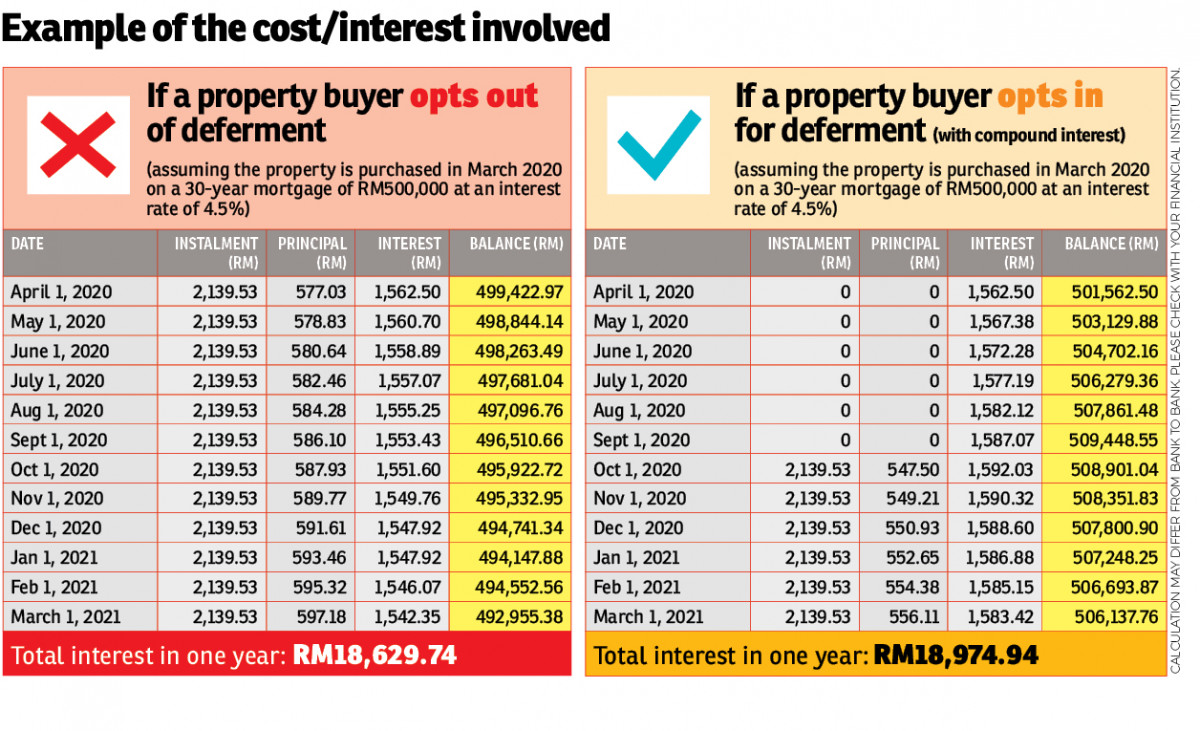

Highly recommended for users with multiple loans and new car buyers. Below is a summarised diagram of a typical car loan application process in malaysia. Depending on the type of loan undertaken you may save money with early settlement. In malaysia you may take out a car loan for a minimum of 1 year to a maximum of 9 years.

Determine how much you should pay and ways to save more on your monthly repayments. Calculate the balance to pay for your hire purchase car loan personal loan. The car loan application process. Depending on your loan amount and interest rate employed your monthly repayments will be bigger for shorter tenured loans.