Assessment And Quit Rent

Majlis bandaraya johor bahru majlis perbandaran jb tengah.

Assessment and quit rent. Land and property owners must known state due dates and assessment rates and act of their own volition in paying the tax. The annual value of a holding as defined in section 2 of the local government act 1976 is the estimated annual rent at which the holding might reasonably be expected to let with the owner paying the cost of repair insurance and other expenses necessary for the maintenance of the. It must be paid by the landlord to the state authority via the land office and is payable in full amount from 1 st january each year and will be in arrears from 1 st june each year. Quit rent and assessment tax is due by a certain date each year without demand from the government.

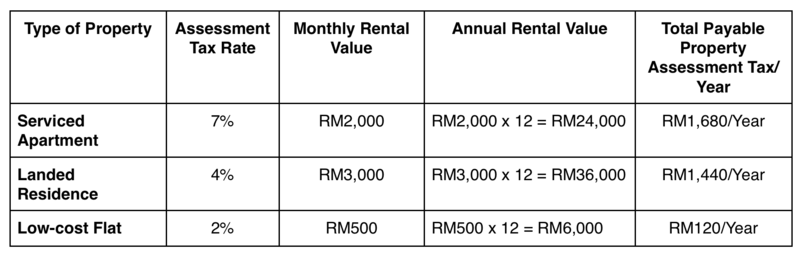

Current accounting practice as observed by the submitter. The submitter claimed that there is divergence in practice on the treatment of quit rent for land held for property development. Assessment rates of property is rm3 000 x 10 rm300 per annum or rm150 every 6 months. Assessment rates or cukai pintu is a local land tax collected by local councils to pay for developing and maintaining local infrastructure and services.

Quit rent is a form of land tax collected by state governments via land office and is imposed on owners of all alienated land freehold and leasehold land. Whether the quit rent for land held for property development should be capitalised as part of the cost of land or expensed off in profit or loss. Cukai tanah is calculated at a varying rate depending on the type and size of the property that is built on the land. Quit rent or cukai tanah is a form of land tax collected by your state government for property in malaysia.

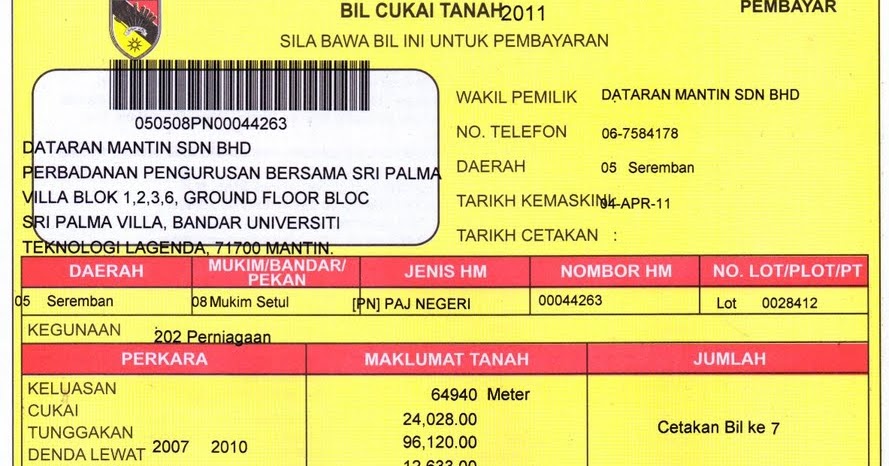

In the case of parcel rent and quit rent those small variations would refer to one main thing. Those who pay either tax after the due date must pay a fine. How is quit rent calculated. 11 digit account no view sample.

The bill is yellow in colour. The quit rent is calculated by multiplying the size of an owned property in sq ft or sq mtrs by a specified rental rate. Quit rent is a form of land tax collected by state governments via land office and is imposed on owners of all alienated land freehold and leasehold land. Quit rent cukai tanah is a tax imposed on private properties.

Assessment and quit rent. Cukai tanah also known as quit rent or land tax is the tax you pay on owning whatever it is that you own on a piece of land even if it s just the land itself.