Advantages Of Sst In Malaysia

The advantages for sst are.

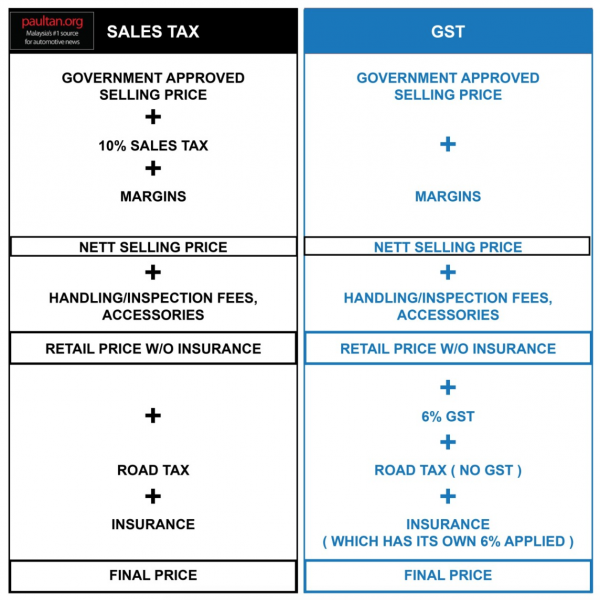

Advantages of sst in malaysia. For the sst system to function proper documentation has to be kept. Director for small enterprises at kuala lumpur malaysia. Sales tax is to be imposed only on the manufacturer of products while the service tax is to be imposed on the provider of services. One expected benefit from the sst is a lower cost of living as sales tax is charged just once by the manufacturer at the point of sale.

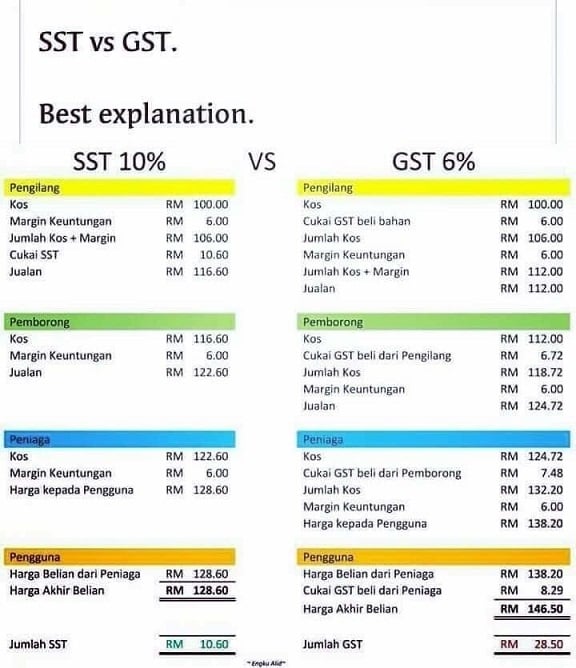

The tax cut also helps to support consumer spending. The advantages of sst are numerous. This means the cost of living will probably go down for everyone consumption will increase and businesses will be able to present their products and services at competitive prices. The first would of course be having in place a more efficient tax system to replace the present sales tax and service tax which have inherent weaknesses and hence revenue leakages.

Thus sst is paid on the value added. Answered may 22 2019 author has 787 answers and 526k answer views. Sst helps to provide convenience to consumers since only 38 of goods and services in the consumer price index cpi basket is taxed which is a huge difference compared to the gst which was 60. It is a single stage tax imposed on factories or importer at 10.

There are also middle men who take advantage of gst to raise prices and use the tax as a convenient reason to make more money. The tax system is to pass through innovation to make it acceptable to those who want to. Sst is a single stage tax meaning that it is imposed only once during the entire supply chain either at the time of manufactured or at the time imported in malaysia. While sst will cause the government a tax revenue drop estimated at rm25 billion sst is seen as a less progressive form of tax and many countries have moved on to gst.

What is sst in malaysia. There are many advantages that all kinds of businesses can enjoy with this new tax regime which makes business creation in malaysia a good opportunity particularly if the above mentioned advantages are what the proposed company in malaysia would enjoy. They are liable to register for this service tax under the 2018 act. Malaysia s service tax is a form of indirect tax imposed on any provision of taxable services made in the course or furtherance of any business by a taxable person in malaysia.

Service tax is not chargeable on imported services and exported services. Malaysia s special designated areas including langkawi island tioman island and labuan federal territory are exempt from the service tax.